Week in Review – February 7, 2020

The crude market was up and down for the week but ended relatively unchanged. The week started lower on the news from anonymous Chinese officials stating that oil demand was down 3 MMbpd. However, news of possible treatments for the coronavirus helped to buoy crude markets to close the week at the same level where we started the week. A mid-week inventory report showed a build in crude inventories but draws for fuel markets, bringing mixed results.

Political tensions are flaring among OPEC and Non-OPEC members as the group known as OPEC+ considers production cuts. With Chinese demand significantly reduced in light of virus concerns, OPEC’s Joint Technical Committee recommended a further 600 kbpd production cut extending through June, which both deepens existing cuts and extends them for longer. The committee also suggested extending the current 2.1 MMbpd cuts, currently set to expire in March, until the end of 2020.

Russia blocked the proposal and instead suggested meeting in early March to address the concerns. With demand down as much as it was during the 2008-09 recession, markets are demanding action. OPEC members say they expect Russia to come around within days, not weeks.

Prices in Review

WTI Crude opened the week on Tuesday at $51.01. It went up and down through the week based on current news. Crude opened Friday at $51.11, a gain of 10 cents (0.2%).

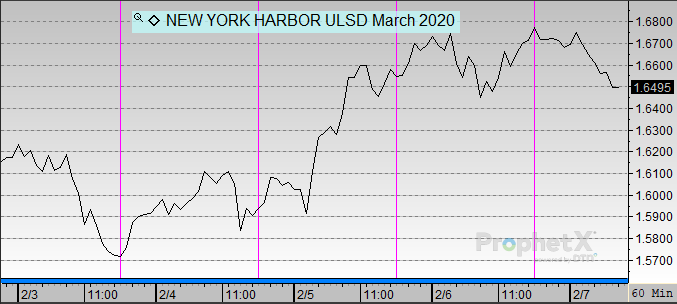

Diesel opened the week at $1.6188. It departed from crude on Thursday to remain higher on news of coronavirus treatments instead of dropping back down. Diesel opened Friday at $1.6712, a gain of 5.2 cents (3.2%).

Gasoline opened the week at $1.4900. It roughly followed crude through the week. Gasoline opened Friday at $1.4981, a gain of 0.8 cents (0.5%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.