OPEC+ Considers Further Cuts

Yesterday, crude prices closed higher after the World Health Organization reassured markets that China would contain the coronavirus. The World Health Organization stopped short of calling the virus an international emergency on Tuesday, while expressing confidence that China’s leadership would contain the virus in the coming weeks.

Crude prices are up in early trading this morning as OPEC+ officials considered the idea of extending output cuts until June, or even potentially cutting supplies further if oil demand declines from the coronavirus. In addition, bullish inventory news from the API is helping to lift markets.

The API’s data last night:

After a few weeks of hefty builds projected by the API, this week’s draw may help stabilize prices. The API reported a surprise draw for crude of 4.3 MMbbls versus an expected build of 0.5 MMbbls. At Cushing, stocks rose with a build of 1.0 MMbbls. The API reported distillates had a smaller-than-expected draw and gasoline had a larger-than-expected build. The EIA will report numbers later this morning. Last week, the EIA reported numbers far more bullish than the API, so we’ll see if the numbers disagree again this week.

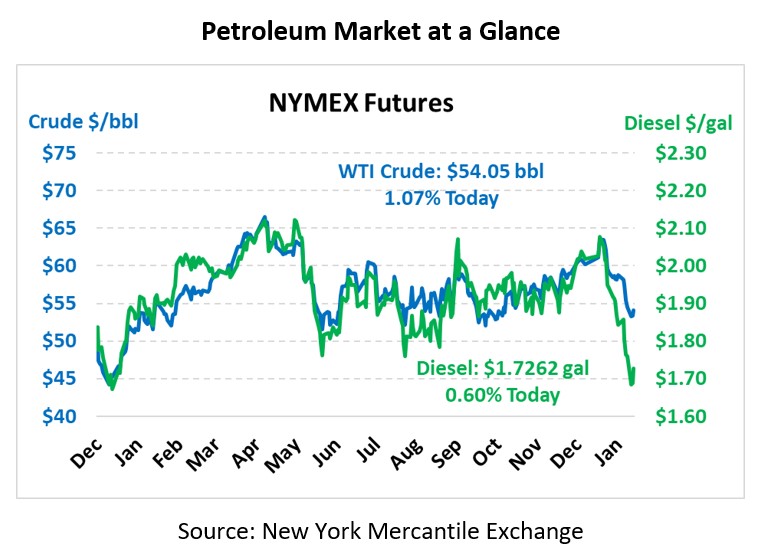

Crude prices are up this morning. WTI Crude is trading at $54.05, a gain of 57 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.7262, a gain of 1.0 cents. Gasoline is trading at $1.5260, a gain of 2.3 cents.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.