Week in Review – January 17, 2020

The crude market was relatively flat for the week, a reprieve from the large ups and downs seen over the last few months. Markets were mainly focused on the signing of the Phase One trade deal between the US and China, though after months of conversations most of the effect had already been priced into the market. Prior to the signing of the trade deal, the label of currency manipulator was taken off China which bumped up markets on Tuesday.

In inventory news, a near 15 MMbbls total products build reported by the EIA kept markets lower on Wednesday. Most of the build was seen in product markets, while crude drew by 2.5 MMbbls compared to analysts’ expectation for a 0.5 MMbbls draw. By Thursday, crude markets had recovered much of Wednesday’s losses.

Prices in Review

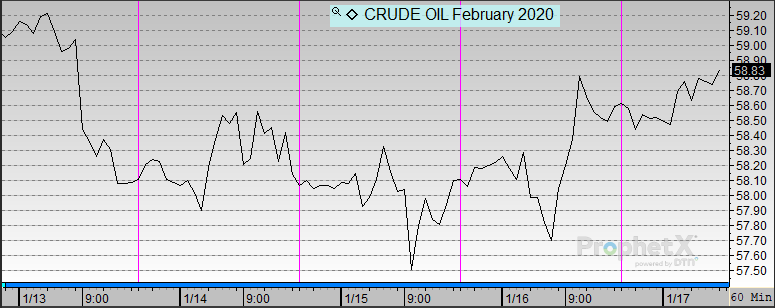

WTI Crude opened the week at $59.04. It was up and down through the week, dipping mid-week and lifting as the week closed. Crude opened Friday at $58.59, a loss of 45 cents (-0.8%).

Diesel opened the week at $1.9366. Following crude’s descent early in the week, a massive 8.2 million barrel build cause diesel to decouple from oil’s recovery, maintaining a downward trajectory throughout the week. Diesel opened Friday at $1.8618, a loss of 7.5 cents (-3.9%).

Gasoline opened the week at $1.6668. Although gasoline also saw a hefty 6.7 million barrel draw, the large number only adds to an already over-supplied gasoline market, so traders didn’t have much reaction. Gas generally followed crude throughout the week, opening Friday at $1.6644, a loss of 0.2 cents (-0.1%).

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.