Week in Review – January 10, 2020

The crude market was down for the week. The major news for the week driving markets was Iran’s retaliation on Wednesday for the US killing Iranian military commander Qassem Soleimani. Iran’s missile attack targeted equipment at two air bases from which the Soleimani’s attack was launched. There were no reports of casualties or injuries. This measured Iranian response was accompanied by an announcement from Iran calling for no further escalation to the situation. Markets read these actions as a de-escalation, and Trump seems to agree.

In inventory news, a surprise build reported by the EIA helped to drive markets lower this week. Crude built by 1.2 MMbbls compared to analysts’ expectation for a 3.6 mmbbls draw. This was the first crude build since the week of December 5th.

Prices in Review

WTI Crude opened the week at $63.71. On Wednesday the price spiked on initial news of Iran’s retaliation, but fell as more news came in showing de-escalation. Crude opened Friday at $59.61, a loss of $4.10 (-6.4%).

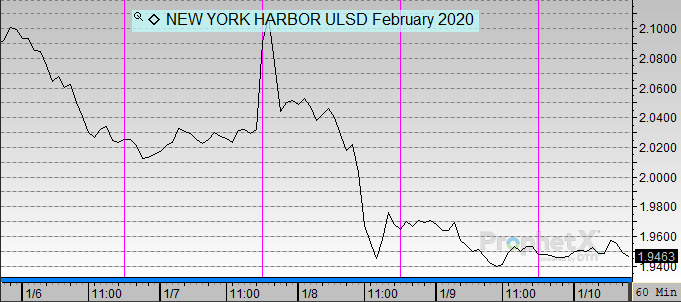

Diesel opened the week at $2.0755. It followed crude through the week to spike then drop on Wednesday. Diesel opened Friday at $1.9522, a loss of 12.3 cents (-5.9%).

Gasoline opened the week at $1.7556. It also followed crude throughout the week. Gasoline opened Friday at $1.6579, a loss of 9.8 cents (5.6%).

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.