Ringing in the New Year

Happy New Year!

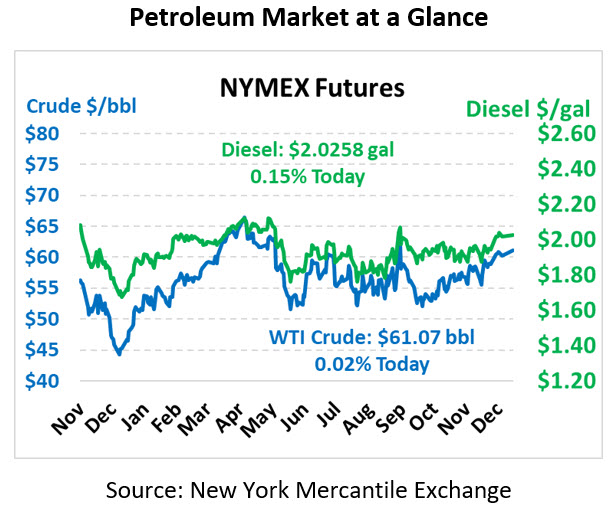

On this first trading day of the new decade, the market is in line with the pricing of the past few days, slightly above $61 but making little attempt at moving any higher. Currently the crude oil market is trading at $61.07, flat with Tuesday’s closing price.

Fuel prices have lately been keeping in line with crude oil price activity, but today prices are seeking a bit more upward action. Diesel prices are currently trading at $2.0258, up 0.3 cents. Gasoline prices are currently $1.7062, up 1.6 cents.

Looking back at a year of oil prices, the market demonstrated remarkable consistency relative to other years. Throughout 2019, prices remained in a band of $50-$65, with exactly half (122 out of 243 trading days) spent between $55-$60 per barrel. Compare this with 2018, which saw a low of $40/bbl and a high of $75/bbl. Yet 2019 brought some of the most significant geopolitical events in recent history, complete with trade wars, missile strikes, Iranian and Venezuelan sanctions, and an impeachment. The new decade will have a hard time competing with the shear number of dominating headlines experienced last year.

2019 Crude Oil Prices

In more recent news, Trump has announced a target deadline of January 15 to sign the recent Phase 1 of the trade deal, adding credibility that the deal will in fact be signed. The deal has lifted economic gloom, if only temporarily, to bring equity markets higher. Meanwhile, hefty crude inventory draws over the past two weeks are putting more upward pressure on oil markets as year-end demand rises. OPEC’s deeper production cuts also go into effect today, which may bring further market price support.

In a final bit of 2019 review, EIA data shows that OPEC imports into the US fell to their lowest point since data began collection in 1993. In October, OPEC crude imports were down 14% relative to September and a whopping 50% below October 2018 levels. The Shale Revolution continues to support America’s dominance, and this latest data shows that shale production has gifted America with reduced reliance on Middle East oil even as we become more intricately linked to global oil prices.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.