Week in Review

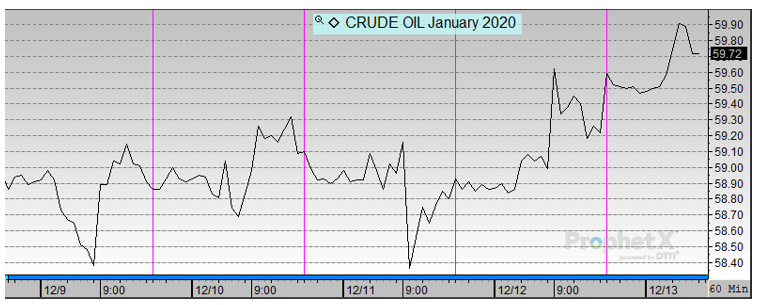

The crude market was up for the week. It started the week relatively unchanged on little news, but as mid-week came around, the markets fell on bearish inventory numbers. On Wednesday, prices recovered from session lows on positive trade sentiment and the markets closed the week higher on news of a phase one trade deal agreed to by Trump although not yet confirmed by China.

The president signing off on the agreement will officially delay the round of tariffs scheduled for Sunday. Even with a phase one trade deal in place, the deal could leave tariffs on many goods and would not address major concessions Trump has sought, such as unrestricted access for US companies. China’s lack of response to the news of the agreement suggests that China and the US are still struggling to come to a compromise on the details of a broader deal.

Prices in Review

WTI Crude opened the week at $59.11. It was flat until mid-week when trade news began to lift the market. Crude opened Friday at $59.36, a gain of 25 cents (0.4%)

Diesel opened the week at $1.9547. It fell mid-week on inventory numbers but closed the week higher on trade news. Diesel is trading higher on Friday morning. Diesel opened Friday at $1.9553, a fractional gain.

Gasoline opened the week at $1.6475. It was up and down all week – dropping mid-week on inventory news and recovering on trade news. Gasoline opened Friday at $1.6325, a loss of 1.5 cents (-0.9%). It is trading higher early Friday morning.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.