OPEC Cuts Elevate Markets

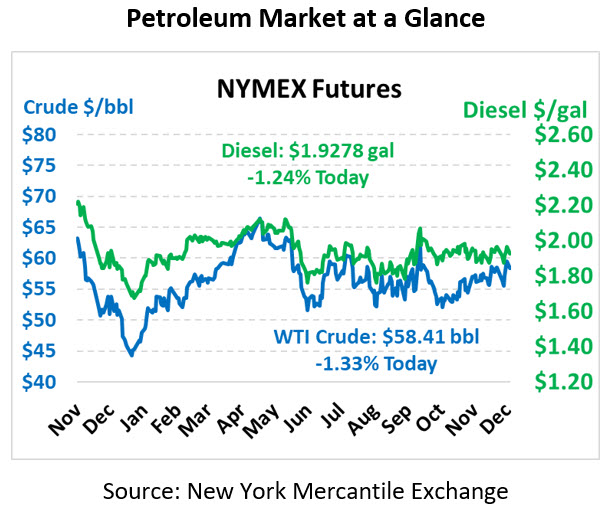

Oil prices are lower early Monday amid profit taking from last week’s gains. Crude oil is currently trading at $58.41, down 79 cents.

Fuel is also down this morning. Diesel is trading at $1.9278, a loss of 2.4 cents. Gasoline is also lower, trading at $1.6289, down 1.9 cents.

On Friday, crude prices rose following Saudi Arabia’s announcement that it would deepen supply cuts with OPEC partners by an additional 500 kbpd until March to bring the cut target to 1.7 mmbpd. It was the highest close since the drone attacks on Saudi oil infrastructure in September. The three-month supply cut news had a similar effect on markets as the short-term supply outage caused by the September attack. We will wait to see if prices remain elevated or return to lower levels as we have seen time and again this year.

Markets considered the real effect of the new supply cuts as Saudi Arabia had already been over complying with their cuts to try and balance markets and lift prices. Oil prices were higher for the week on a combination of OPEC, friendly weekly oil inventory data and a strong jobs report for the US – suggesting that the US economy is still growing with no recession in sight.

In trade news, China has reportedly agreed to lower the tariffs on soybeans and pork as a good will gesture as talks continue. This gesture shows that at the very least, the US and China are still at the table discussing a future trade deal while the deadline for new tariffs is looming around the corner on December 15. The markets eagerly await news from negotiations and hope for trade progress.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.