Week in Review – November 22, 2019

The crude market was up for the week. The market was down to start the week as it dealt with pessimistic trade news. In addition, Russia had announced it was against deeper supply cuts. The oil complex seemed to ignore any bearish news to end the week and it surged higher on even the slightest bullish news.

Markets were lifted when Russia affirmed that it would continue its cooperation with OPEC to keep the global oil market balanced. Pessimistic trade sentiment from US-China trade talks at the end of the week was ignored as traders seemed to latch onto slightly bullish inventory news reported by the EIA of a smaller-than-expected build in crude stocks and a sizable draw from Cushing for the second straight week.

Prices in Review

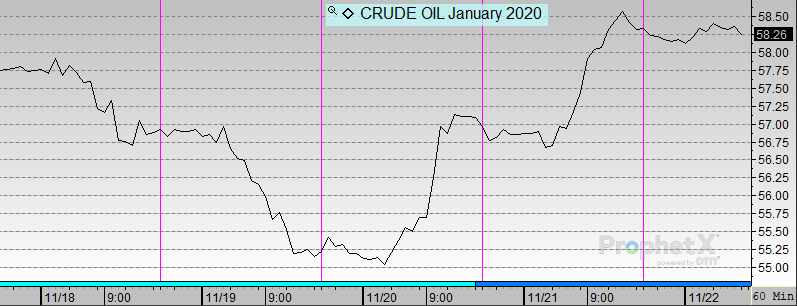

WTI Crude opened the week at $57.88. It was down to start the week but finished higher – starting the rally mid-week. Crude opened Friday at $58.31, a gain of 43 cents (0.7%).

Diesel opened the week at $1.9533. It started down for the week and rallied mid-week to finish the week still down. Diesel opened Friday at $1.9401, down 1.3 cents (-0.7%).

Gasoline opened the week at $1.6402. It was relatively flat to open the week and rallied mid-week to close higher. Gasoline opened Friday at $1.6971, a gain of 5.7 cents (3.5%).

This article is part of Crude

Tagged: eia, Russia, US-China trade

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.