Inventory Build Beats Positive Trade Sentiment

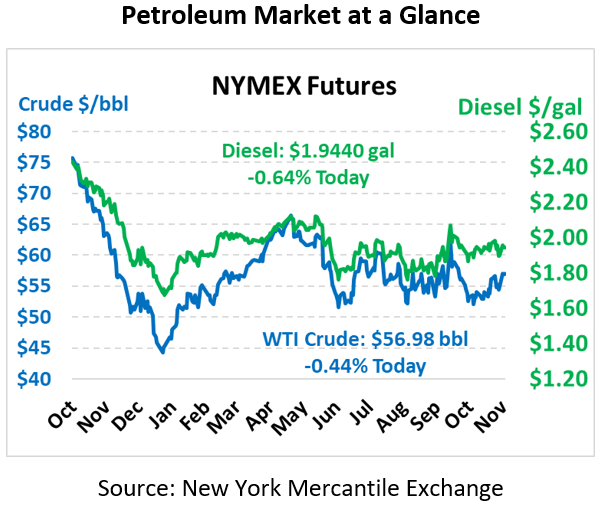

A larger-than-expected build in crude stocks is putting downward pressure on prices this morning. WTI Crude is trading at $56.98, a loss of 25 cents.

Fuel is down this morning. Diesel is trading at $1.9440, a loss of 1.3 cents. Gasoline is trading at $1.6573, a loss of 1.7 cents.

On Tuesday, crude prices rose after more positive signals for deeper OPEC cuts. In addition, positive sentiment regarding US and China trade negotiations have been lifting the market for the last three session, but this sentiment may be running out of steam in the face of bearish inventory data from the API.

The API’s data last night:

The API reported a larger-than-expected build for crude of 4.3 MMbbls versus an expected build of 1.5 MMbbls. At Cushing, stocks rose for the seventh week in a row with a build of 1.3 MMbbls. Products experienced draws with distillates and gasoline both experiencing a larger-than-expected draw. The crude market is down in early trading Wednesday in anticipation of EIA data coming out later this morning.

In OPEC news, Iraq has maintained its oil production steady at 4.62 mmbpd in October despite a large decrease in exports, the country’s State Oil Marketing Organization said Tuesday. The figure remains far greater than its OPEC output quota of 4.512 mmbpd under the current agreements in spite of many assurances by Iraq it would adhere to the ongoing cuts; October crude output remained unchanged even with a 111 kbpd MoM fall in the country’s crude exports.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.