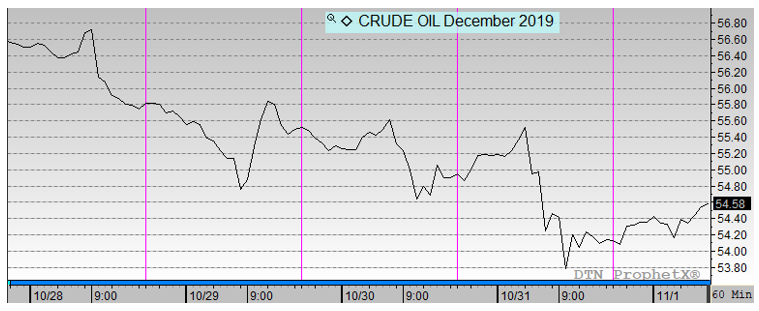

Week in Review – November 1, 2019

The Crude Market was down for the week. Pessimism regarding delays in signing a phase 1 trade deal with China have helped to bring the market lower this week. Mid-week the Fed cut interest rates 25 basis points but that hardly registered in the crude market because of a larger-than-expected crude build reported by the EIA on Wednesday. The inventory news was the major driver to move markets lower to end the week along with negative sentiment around trade deal delays.

In OPEC+ news, Saudi Arabia and Russia are on opposite sides regarding talking about future cuts. This week, Russia stated that it was too early to discuss future cuts, while Saudi Arabia said it would do whatever was necessary to balance the markets including enacting deeper production cuts. These mixed signals were not well received my the market.

Prices in Review

WTI Crude opened the week at $56.65. It had a steady downward trajectory throughout the week. Crude opened Friday at $54.15, a loss of $2.50 (-4.4%).

Diesel opened the week at $1.9780. It generally followed crude down all week. Diesel opened Friday at $1.8749, a loss of 10.3 cents (-5.2%).

Gasoline opened the week at $1.6694. It was relatively flat to open the week but took a nosedive mid-week and after. Gasoline opened Friday at $1.5946, a loss of 7.5 cents (-4.5%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.