Economy Weighs on Prices Despite Middle East Turmoil

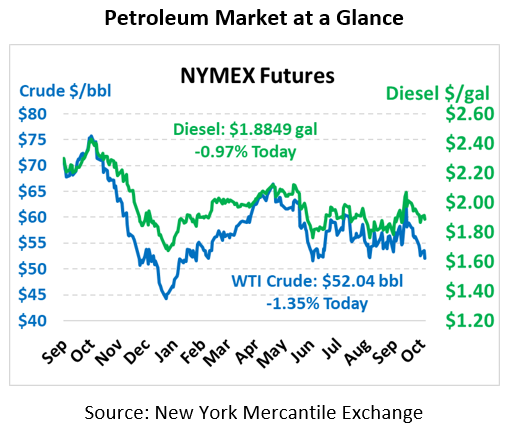

After a brief pause on Friday and Monday, oil prices are resuming their downward trajectory. Economic fears have weighed heavily on the market, keeping a lid on any short-term bullish sentiments. Crude oil prices are currently trading at $52.04, down 71 cents.

Fuel prices are also dropping lower once again. Diesel prices are trading at $1.8849, down 1.8 cents from yesterday’s close. Gasoline prices are trading at $1.5479, losing 2.2 cents.

Economic fears have outweighed any bullish sentiments flashing across headlines. Trump indicated that a fast resolution of the US-China trade war seems unlikely, which matches general consensus in the market. The US also blacklisted 28 Chinese companies for being involved in human rights violations involving involuntary holding of minority Chinese groups such as the Uyghurs, Kazakhs and others. China has expressed the possibility of a deal coming to fruition, though officials hinted that a deal may be limited only to areas in which the US and China already agree.

On the more bullish side of the equation, President Trump yesterday withdrew troops from Syria to make way for Turkish soldiers, a surprising reversal in foreign policy stance. Syrian Kurds have been a key ally in America’s fight against ISIS, but Turkey considers them a terrorist group. Congressional Republicans have warned that withdrawing would negatively impact our allies and damage US credibility. Trump took to Twitter to defend the measure, saying that he would respond if Turkey does anything in violation of his “great and unmatched wisdom.”

While Syria is by no means a major oil producer, it certainly sits close to plenty of other producers. Instability in the Middle East tends to spill over to oil price concerns, so this will be a key area to watch over the next few months – especially if Turkey oversteps and Congress steps in with sanctions.

Adding to price risk premiums, OPEC countries have been struggling with production instability. In Iraq, protests threaten to disrupt export flows (estimated to be 3.4 MMbpd) if protestors target oil infrastructure. Likewise, protests in Ecuador could disrupt production, though the expected disruption there would be orders of magnitude lower than in Iraq.

This article is part of Crude

Tagged: blacklisted, bullish, foreign policy, ISIS, Middle East, oil prices, opec, Syria, Trump, US-China trade war

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.