Negative Manufacturing Reports Drive Equities and Oil Lower

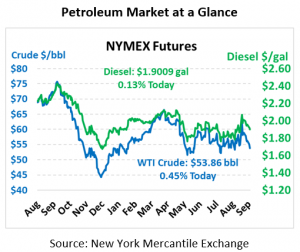

After a bullish start yesterday, oil followed equities lower after poor manufacturing reports. This led to the sixth straight day of losses for crude. API reports of a surprise draw in crude are lifting markets this morning. WTI Crude is trading at $53.86, a gain of 24 cents.

Fuel is flat this morning. Diesel is trading at $1.9009, a gain of 0.2 cents. Gasoline is virtually unchanged, trading at $1.5733, a fractional loss.

Equities were down yesterday after poor manufacturing reports showing a contraction. The Institute for Supply Management (ISM) showed that US manufacturing activity dropped to a more than decade-low in September as the US-China trade war weighed on exports. Manufacturing is an energy intense sector, and this suggests that oil demand is slowing as well. Oil fell 2% yesterday, following equities lower.

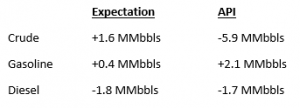

The API’s data last night:

The API reported a surprise draw for crude of 5.9 MMbbls versus an expected build of 1.6 MMbbls. This reported build is helping to buoy markets this morning. At Cushing, stocks rose for the second week in a row with a small build of 0.5 MMbbls. Gasoline had a larger than expected build reported by the API. Diesel was in line with expectations.

In OPEC+ news, Ecuador has announced that it will leave OPEC in January 2020. This follows months of non-compliance for Ecuador with the OPEC supply-cutting quota. Ecuador produces 530 kbpd of crude. This small amount of production will not materially affect OPEC+ output or decisions.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.