Saudi Attack Continues Dominating Headlines

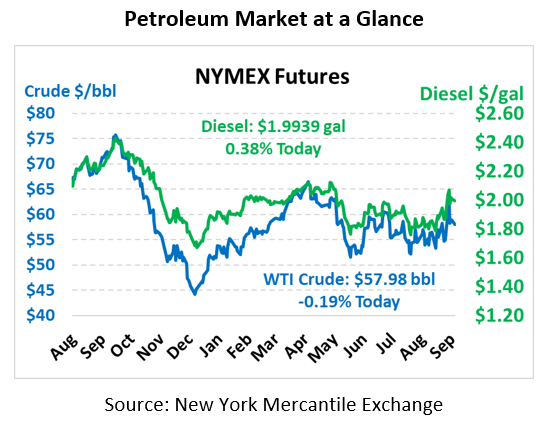

Oil prices are generally flat following small losses last Friday, as markets continue cooling from Saudi-related news. Crude oil is currently trading at $57.98, hardly changed from Friday’s close.

Fuel prices are seeing mixed results, decoupled from crude’s sideways trade. Diesel prices are trading at $1.9939, moderately above Friday’s close with 0.8 cent gains. Gasoline prices are $1.6673, down 1.1 cents.

Updates from Saudi Arabia continue to point towards a quick recovery. The kingdom has restored 75% of its output according to Reuters reports this morning, leaving just 1.5-2.0 MMbpd of production offline. Saudi Aramco, the country’s national oil company, has reportedly been paying top dollar to expedite repairs. Saudi oil has long been considered the world’s premier supply source, able to balance global inventories and control prices. The attacks called its resilience into question, so the country is rushing to repair its tarnished reputation.

In response to the attack, Saudi Arabia launched airstrikes this weekend on the Iran-backed Houthi rebels in Yemen, who originally took credit for the attacks. Last week, the US tightened sanctions further on Iran, targeting their central bank. At this point a direct attack by the US or Saudi Arabia on Iran seems unlikely, despite continued international consensus that Iran was the perpetrator of the attacks.

To summarize: While news about the Saudi attack has calmed and turned more neutral for prices, it’s still basically all the news and oil markets are talking about.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.