Oil Reports Bearish, Summer Gasoline Ends

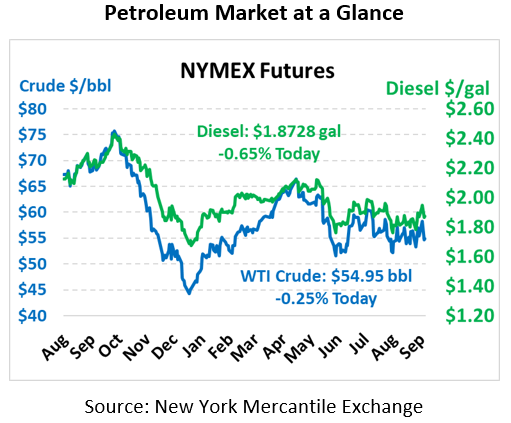

Markets are seeing mixed trends after a slump yesterday. Numerous oil market reports have been released this week, including those from the EIA, OPEC and the IEA, providing insights into upcoming market trends. Crude oil prices are currently trading at $54.95, down 14 cents from Thursday’s close.

Fuel prices are trading sideways after some moderate losses yesterday. Diesel is trading at $1.8728, a loss of 1.2 cents. Gasoline is flat, trading at $1.5499, down 0.3 cents

In Iran news, Treasury Secretary Steven Mnuchin has clarified that the US has no intention of easing sanctions in exchange for resumed negotiations with Iran. The announcement comes after speculation that National Security Advisor John Bolton’s firing would bring a change in foreign policy approach. Iran has stated they will not resume negotiations until sanctions are eased, putting the US and Iran at a stand-off until one changes its approach.

The monthly reports revealed a few different stances on global oil markets, though across the board the picture looks bearish in H1 2020 and more supportive in H2 2020. The IEA and OPEC kept demand prospects generally unchanged for this year at 1 MMbpd, while the EIA revised its projection down to 0.9 MMbpd. The IEA is perhaps the most optimistic in its economic outlook, noting “no further deterioration” in the economy or the trade war this year. OPEC noted a softer market ahead this year but added that the group remains vigilant in managing market conditions.

Next week will bring an end to summer’s High-RVP gasoline, a product which has lower emissions in the summer heat. Lower RVP fuel requires stricter refinery requirements, making it more expensive, so expect to see gasoline prices ease in the week ahead. NYMEX futures, which point towards future month (October) prices, have already made the switch, seeing a roughly 14-cent drop on Sept 1.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.