Trump Eases Iran Approach

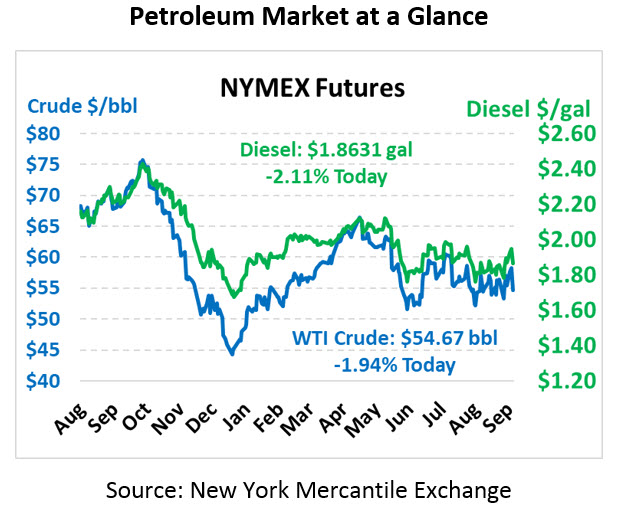

Oil markets fell yesterday following news of a possible softening stance with Iran. WTI Crude is trading at $54.67, a loss of $1.08.

Fuel is down, following crude lower. Diesel is trading at $1.8631, down 4 cents. Gasoline is trading lower at $1.5319, down 3.8 cents.

The crude market was up in early trading yesterday based on news of easing trade tensions between the U.S. and China. China announced exemptions of some products from additional tariffs. However, the bulls retreated in the afternoon and the market took a nosedive when news came out that Trump was considering easing sanctions on Iran in order to secure a face to face meeting with Iran’s president Rouhani. Trump’s evolving stance on Iran is reportedly behind the decision to fire National Security Advisor John Bolton, known for his hawkish stances.

The markets continue to fall this morning even though the EIA reported some bullish data in their weekly report. Crude stocks fell more than expected – nearly 7 MMbbls, continuing what is now a four-week streak of draws. Notably, stocks in Cushing, OK, America’s largest crude storage hub, have been falling steadily for weeks, grossing 13.2 million barrels down over 10 weeks. New pipelines carrying oil from the Permian to the Gulf Coast have alleviated the build-up in Cushing, which may help narrow the Brent-WTI spread further and push up fuel prices along the Southeast. Gasoline was in line with market expectations but fell short of API estimates. Diesel had a larger than expected build.

At the OPEC JMMC meeting, the organization asked Nigeria and Iraq to reduce their output in order to come into compliance with the current supply-cutting framework. Despite tightening compliance on the current deal, Saudi Energy Minister Prince Abdulaziz bin Salman said that the organization would not make a formal decision on deeper cuts before OPEC’s Dec. 5th meeting. OPEC has generally taken a “wait and see” approach to cuts, putting off decisions until they’ve fully evaluated the supply landscape. In the meantime, expect some price volatility as markets guess at OPEC’s next move.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.