Farmers’ Almanac Calls for “Polar Coaster”

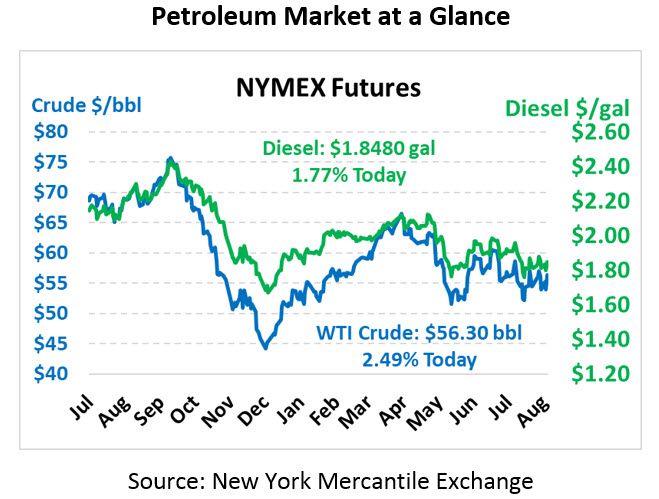

Oil prices have been boosted once again by substantial draws from US crude inventories. The API’s data yesterday afternoon shattered the flat trading of the day, resulting in greater than $1/bbl gains heading into the close. This morning, WTI crude is sustaining that growth, up another $1.37 to trade at $56.30.

Fuel prices are also feeling the boost. Diesel prices are trading at $1.8480, up 3.2 cents from Tuesday’s closing price. Gasoline prices are $1.6720, up 2.2 cents.

The American Petroleum Institute published their weekly data yesterday afternoon, revealing a hefty 11-million barrel draw from crude reserves. Diesel stocks also revealed a large draw, deviating from expectations. The EIA and the API don’t always agree on inventory changes, though, so this morning’s weekly EIA report will be important in confirming or disproving the API’s data.

Less important for prices but important for quite important for diesel buyers, the Farmers’ Almanac is predicting a frigid winter filled with a “Polar Coaster” of temperatures. The coldest part of the season is expected to come in late January and early February, and the Northern half of the country is forecast to experience colder-than-normal temperatures. Of course, some scientists question the legitimacy of long-range weather forecasts, but it’s a helpful early indicator.

If the winter does prove colder than normal, it could be more impactful this year than ever. With IMO 2020 approaching, diesel prices are expected to rise. So far, diesel inventories have been relatively close to average levels; an uptick in weather-related diesel demand mixed with strong marine demand could lead to very strong prices this winter. Last year, prices soared up to $2.40 during the fall season – it will be interesting to see whether prices can muster a similar rally this year.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.