3 Strong Indicators a Recession is Coming

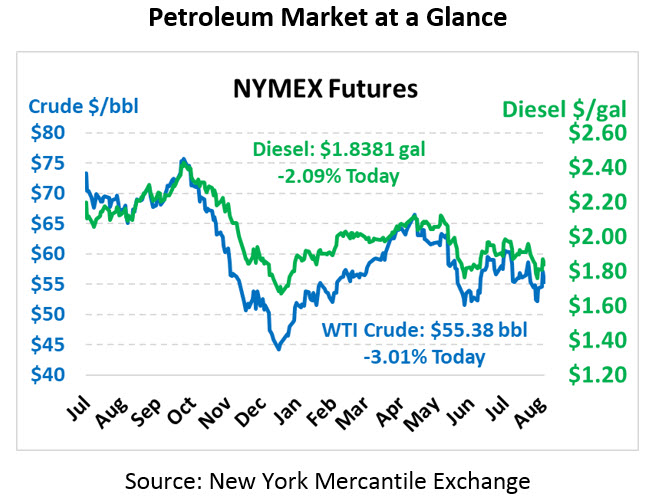

Oil prices are heading south once again after securing $2/bbl gains yesterday, just another turn of the oil price roller coaster we’ve been through this summer. Crude oil prices are trading at $55.38 this morning, down $1.72 from Tuesday’s close.

Fuel prices are also falling today, though not quite as much as crude. Diesel prices are currently $1.8381, down 3.9 cents. Gasoline is trading at $1.6969, down 4.0 cents.

Yesterday’s headline on trade caused prices to rocket higher, and today a headline has reversed the market’s course. The API’s report contained a surprise inventory build for crude stocks, though product inventories were both on the decline. Today’s update from the EIA will help determine whether today’s losses will reverse or continue.

Three economic indicators have all pointed to worsening economic growth prospects for the future. Chinese industrial output growth fell to a 17-year low, highlighting the impacts of the escalating US-China trade war on the industrializing nation. In Germany, heralded as one of the most robust economies in the EU, Q2 economic growth turned negative, putting them on the cusp of declaring a recession (which is generally defined as 2 consecutive quarters of negative GDP growth).

The third indicator is a bit more complicated – and more worrisome. In economic jargon, the yield curve became inverted this morning for the first time since 2005. In normal English, the interest rate on 10-yr bonds just slipped to trading below 2-yr bonds, meaning investors are more worried about getting cash over the next two years than they are about the next 10 years. The inversion signals that markets are expected to grow cash-strapped in the near-term, making it harder to find capital to invest in growth. Yield curve inversions are one of the strongest leading indicators of a recession and have been a precursor to each of the last five recessions. On average, a recession follows such an inversion 22 months after it occurs.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.