Why Interest Rate Cuts Matter for Oil

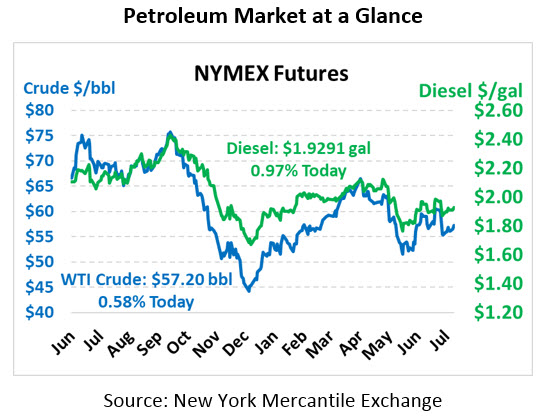

Financial markets are getting a boost from increasing expectations of a Federal Reserve interest rate cut, which would help boost our economy. In the oil arena, this wave of positive sentiment has lifted prices moderately. Crude oil is currently trading at $57.20, up 33 cents.

Fuel prices are trading higher as well, though gasoline is lagging the rest of the market. Gasoline prices are currently trading at $1.8668, up a meager 0.3 cents. Diesel prices are $1.9291, rising faster with 1.9 cent gains.

Markets are hyper-focused on the Federal Reserve, which is now expected to cut interest rates for the first time in over a decade. Typically, the Fed uses interest rates as a throttle for the economy, pushing growth with rate cuts or choking off excessive momentum with rate hikes. In years past, some have criticized the Fed for acting too slow when economic headwinds start blowing; now, it appears Fed Chairman Powell is starting early to facilitate a soft landing for the economy.

Some, such as prominent hedge fund manager Ray Dalio, warn that interest rate cuts will be a short-term stimulus to the economy but at the cost of reduced firepower in the future. Once interest rates fall to 0% (they’re currently between 2.25% and 2.5% and were at 5% before the 2008 recession), the Fed no longer has significant leeway to prop up the economy. Others argue that by cutting rates early, the Fed extends its ability to boost markets by giving it more time to act.

For oil prices, an interest rate cut is unquestionably bullish for the short-term. Lower interest rates promote lower inflation and cause the US dollar to weaken versus foreign currencies, making it cheaper for other countries to buy US goods (including US Dollar-denominated currencies like oil). That in turn drives demand in the financial oil markets, driving oil prices higher. Over the longer-term, though, it’s unclear whether the cuts will be positive or negative for oil prices. If it helps avert recession, it will keep oil prices elevated for longer. If it ultimately causes a deeper recession, as Dalio wrote, it would be long-term bearish for oil prices.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.