API Reports 11 MMbbl Draw

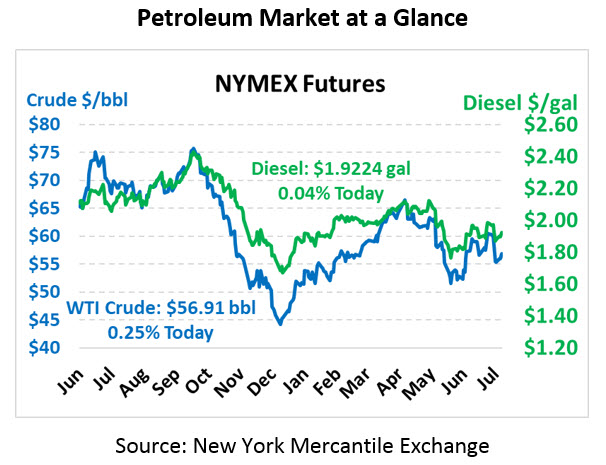

Oil leapt last night as following the API’s report of a hefty crude oil draw. Crude this morning is trading at $56.91, roughly unchanged from yesterday’s higher close.

Fuel is mixed this morning due to the API’s data. Diesel prices are trading flat this morning at $1.9224. Gasoline, which saw a surprise build in inventories, is trading at $1.8508, down a penny.

The US and China are once again taking up negotiations to resolve trade issues, though if these are like previous sessions, don’t expect a lot of progress. Trump and Xi declared a temporary truce at the G20, but meaningful progress on broader tariff packages will be slow. The US trade delegation heads to China on Monday for the first in-person discussions since the G20 meeting in late June.

The API’s data was strongly bullish for crude oil, though markets are holding steady this morning until the EIA confirms the numbers. Crude saw a hefty 11 million barrel draw, compared to 4 million barrel expectations, while both gasoline and diesel saw decent builds.

In the Middle East, tensions seem to have cooled a bit following Iran’s seizure of a British tanker last week. Iran has mentioned they would respond favorably if the UK releases its captured Iranian ship. Britain, on the other hand, has been working with the EU establish a naval unit to protect ships commuting through the Strait of Hormuz. As the single most important oil chokepoint in the world, facilitating 20% of all oil consumed each day, any meaningful threat in the Strait of Hormuz could cause massive disruption of oil flows as well as price shocks.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.