Iranian Oil Builds Off Chinese Shores

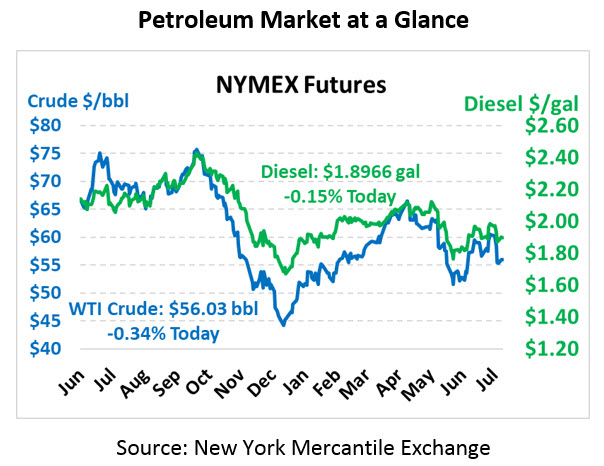

The oil complex remains weaker this morning as markets seek clear direction in sentiment. With Iran and US-China trade both looming over financial markets, traders have little clear direction. This morning, crude is trading at $56.03, down 19 cents.

Fuel prices are mixed this morning. Diesel prices are trading at $1.8966, down a third of a cent from Monday’s close. Gasoline prices are $1.8327, up half a cent.

Yesterday brought a quick resumption of Libyan oil production, following the force majeure event that caused an outage at the country’s largest oil field, El Sharara. The field, which can produce 300 kbpd, has been through several ups and downs over the past year as militias attempt to influence the state through oil attacks. The lifting of force majeure helps cool any fears that the outage will affect global inventories.

As tensions continue escalating with Iran, more scrutiny is being placed on the vessels leaving the country. Recently, vehicle trackers such as Bloomberg have pointed out the number of shipments heading from Iran to China, noting that so far the oil has remained in bonded storage at Chinese ports. Their bonded status means the stocks are still deemed “in transit” and therefore do not violate US sanctions, though the build-up just offshore allows China to dip heavier into its current reserves, knowing replenishment is nearby. While Iran still technically owns the fuel, a large percentage of the stored oil is thought to be shipped under oil-for-investment style deals (specifically, China invested in past projects and is entitled to oil in return). If/when those reserves are converted to legitimate Chinese products, it could dampen demand from one of the largest demand centers in the world, potentially causing oil prices to fall steeply.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.