US Shoots Iranian Drone, Saudi Shows Budget Deficit from Lower Prices

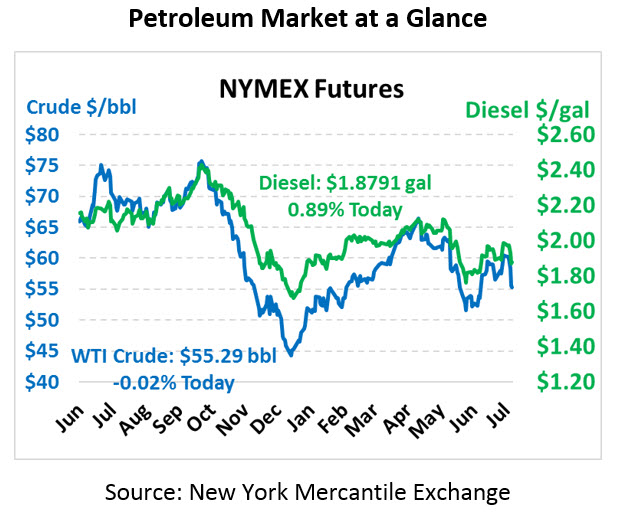

Oil continued sliding yesterday after trading briefly higher in the morning. The decline is partially a response to Tropical Storm Barry’s non-event for petroleum infrastructure, and despite on-going escalation in Iran, markets are still creeping down. Crude oil is currently trading at $55.29, down a penny.

Fuel prices are up or flat with diesel trading at $1.8791, up 1.7 cents. Gasoline is flat, trading at $1.8351.

Yesterday the US shot down what they claimed was an Iranian drone that was threatening a US vessel, though the Iranians claimed they have not lost any drones. The event reportedly occurred in the Strait of Hormuz, adding further to concerns that the key oil chokepoint has become a dangerous region. On the flip side, Iran’s Foreign Minister Zarif has offered a nuclear deal with stricter nuclear inspections on the condition that sanctions are permanently lifted. Trump, though, has been pushing a stricter stance around other programs including their ballistic missile program, so the offer may prove a non-starter.

Saudi Arabia’s government budget was projected to be at a 6.5% deficit according to an IMF report, highlighting the affects of lower oil prices on the country’s budget. While the country has outwardly stated that $70 is the target, the analysis indicates that $60-$65 Brent crude levels are sufficient to keep the country’s budget nearly balanced. Understanding Saudi Arabia’s oil price requirements helps inform a solid understanding of OPEC strategy – as the leading nation, the Saudis will continue to push for at least enough cuts to keep prices in the range they’re in today, if not slightly higher.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.