Markets Waiting for Direction

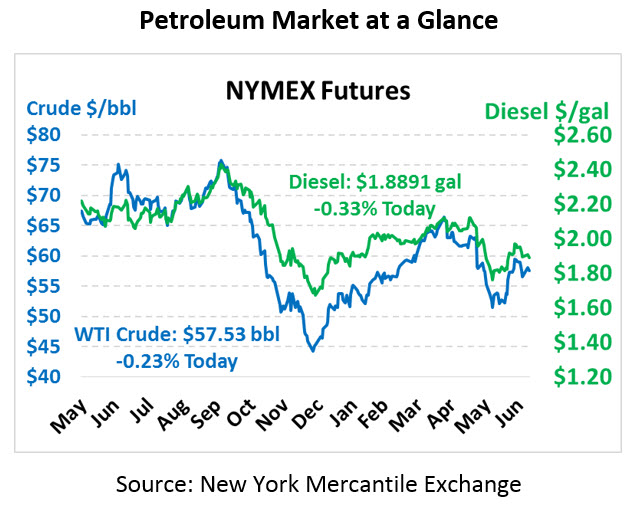

Since dropping sharply on July 2, oil markets have been floating fairly steady – it seems without a trade war update or new missile strikes, the more mundane news of the day just isn’t exciting enough to spark movement. Crude oil is currently trading at $57.53, down a few cents from Monday’s close.

Fuel seems equally tired after the holiday weekend, though gasoline has seen more ups and downs. Gasoline prices sank more than 2.5 cents yesterday, but this morning are trading up 1.9 cents to $1.9205. On the other hand, diesel is largely unchanged at $1.8891, a mere 0.6 cent drop.

Markets seem un-phased by Iran’s threat to retaliate after British forces seized an Iranian oil vessel near the Straits of Gibraltar, claiming it violated US sanctions. A BP vessel was forced to re-route to avoid the now-volatile Strait of Hormuz, further stoking fears that Iran may attempt to shut the waterway through which 1/3 of all seaborne-traded oil flows. With Iran now openly in breach of the 2015 Nuclear Deal, other countries are beginning to threaten to enforce sanctions as well, which could further clamp down on Iran’s remaining 300 kbpd of exports.

Markets are looking to the Federal Reserve for guidance now. The Fed has held interest rates steady through the past few meetings, but the language from the group has turned decidedly more accommodating for markets. While US data seems strong, markets are increasingly expecting an interest rate cut in the next few months. Although such a move would signal a weak economy, it would also provide near-term support for financial markets and weaken the US dollar, which incentivizes US exports and higher oil prices.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.