OPEC Reveals Long-Term Cut Strategy

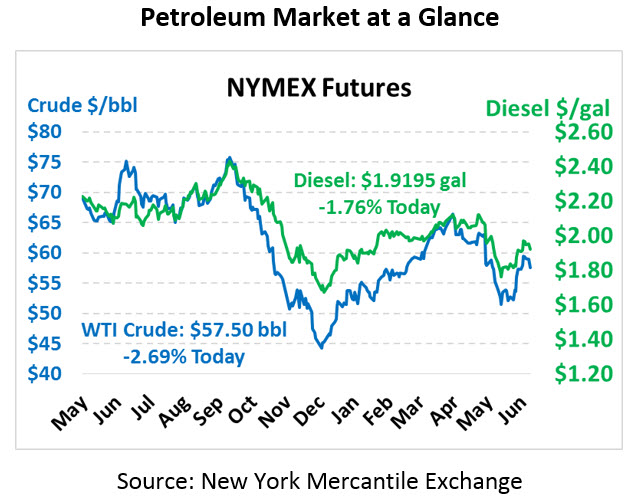

Markets are cooling quickly this morning after a wild ride yesterday. Prices soared in yesterday’s early morning trading, but settled more than a dollar below the day’s highs. Today, markets are sinking, unable to garner strength to re-approach $60/bbl. Crude oil is currently trading at $57.50, down $1.59 from Monday’s close.

Fuel prices are also sharply lower this morning. Diesel prices are trading at $1.9195, a loss of 3.4 cents. Gasoline prices are $1.8903, down 4 cents.

OPEC officially announced plans to extend OPEC+ cuts for the next 9 months, extending through the low-demand winter season. The group also adopted a charter to govern the OPEC+ framework, which includes OPEC along with other independents such as Russia and Mexico. The charter solidifies the group’s collective actions, which Saudi Arabia noted may become a permanent fixture of the market. The last major reveal was that OPEC is now targeting a return to 2010-2014 averages, rather than simply using a 5-year rolling average. To return to the historical norm for inventories, the group would have to drain 160 million barrels from global inventories – a task that would take years even without the added challenge of burgeoning production in the US.

Markets yesterday saw fuel prices outperform crude on continued fears of supply shortages in the Northeast. Keep in mind that NYMEX prices are based on NY Harbor, so local supply shortages may affect RBOB (gasoline) and HO (diesel) contracts. In addition to the shutdown of the PES refinery, the P66 Bayway refinery in New Jersey is now experiencing some unexpected maintenance, though the outage should only last this week. The refinery can process up to 240 kbpd, and the site had to shut off a 145 kbpd unit. Estimates put the expected fuel shortfall around 15.75 MM gallons of gasoline and 8.4 MM gallons of diesel.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.