Today’s Trend

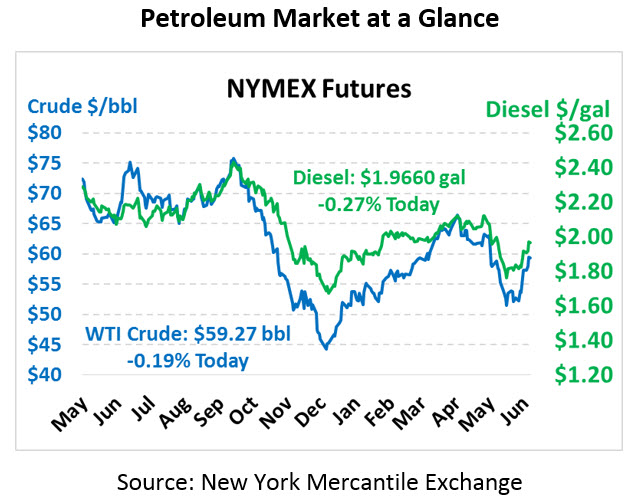

Oil is taking a breather after several days of hefty gains. Last week, prices began at $52/bbl; yesterday prices came just shy of $60/bbl in intra-day trading, closing with $1.50 gains. Today crude is trading at $59.27, slightly lower with 11 cent losses.

Fuel prices are dipping lower as well. Diesel prices are down slightly to $1.9660, a 0.5 cent loss. Gasoline prices are seeing steeper losses following huge post-PES outage gains, trading down 2 cents to $1.9505.

Markets are eagerly awaiting news from the G20 Summit, as leaders begin gathering today for tomorrow’s start. The headline story is US-China trade, with Trump indicating the more tariffs are possible depending on this week’s negotiations. At last year’s G20 meeting, Trump and Xi agreed to a three-month delay in tariff escalations. Now, the question is whether the US will apply tariffs to the second half of Chinese imports. Following the G20 is OPEC’s meeting next week to discuss production levels, though the group is widely anticipated to extend the current cuts.

Philadelphia Energy Solutions has officially declared intentions to shut down their 335 kbpd refinery following a massive explosion late last week. The PES refinery was the largest in the Northeast, so downtime is expected to weigh heavily on fuel markets. According to Platts, the site produced nearly 6.5 million gallons of gasoline daily, which will now need to be shipped in from Europe or via the Colonial Pipeline.

PES is clearing its inventory positions and has already begun plans to lay off workers at the refinery. Whether another oil company will purchase the site and invest the expected $200 MM in repairs is yet to be seen. The Northeast has ample supply inventories and numerous supply options, but expect prices to rise to moderate demand and attract more distant suppliers. Some are even looking to finally approve bi-directional flows on the Buckeye pipeline, allowing Midwest refiners better access to the Northeast market.

In today’s second article we explore the EIA’s latest report on US refining capacity and why that matters for consumers in the US.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.