Iran Deal Prospects Are “Closed Forever”

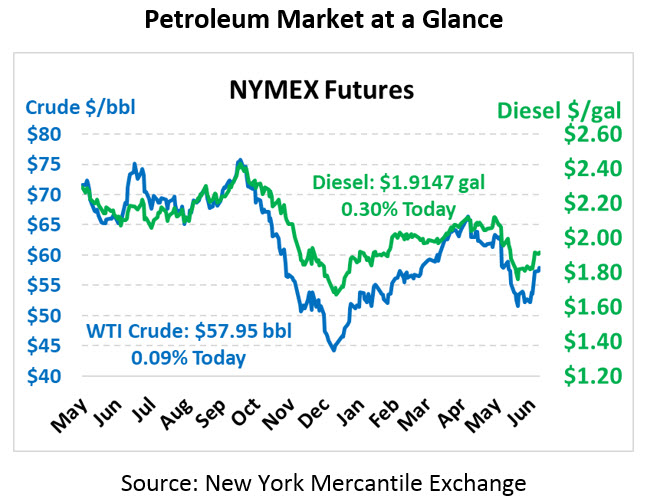

With no news to sustain the recent rally in oil markets, oil prices were largely unchanged yesterday, a phenomenon that appears to be continuing this morning. Crude oil is currently trading at $57.95, virtually unchanged from yesterday’s close.

Fuel prices are mixed, with diesel generally tracking crude oil while gasoline has seen some strong upward momentum. Diesel prices are trading at $1.9147, up half a cent. Gasoline prices are $1.8655, a gain of 1.1 cents following last week’s shutdown at PES’s refinery in Pennsylvania. The outage has caused cargo prices for barged fuel to jump significantly, which will impact Northeastern fuel prices until the refinery resumes full operations.

Trump has announced new sanctions on Iran following their attack on a US drone, a move which comes after the US cancelled missile strikes against the regime. Details of the sanctions are unclear, especially given the current comprehensive sanctions in place, but pundits speculate they could be targeted directly at members of the Iranian military and Iran’s atomic agency. Trump also authorized cyber attacks against Iran. So far, Trump has stopped short of taking direct military action in Iran, though he’s indicated that if Iran kills any Americans, the reaction will be far different in the future. Following the new sanctions, Iran’s Supreme Leader Khameni said that any chance of a nuclear deal are “closed forever.”

With a resolution off the table, any prospect of Iran’s oil returning to the international scene now appear a distant potential. Amid tight sanctions, Iran has been able to maintain its oil production by putting it in storage, but that option may be ending. Already, their storage levels are projected to be at 81% according to a Goldman Sachs report, the highest level in two years. Once storages are full, the country will need to maintain offshore stockpiles while shutting in production.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.