US Accuses Iran of Oil Tanker Attacks

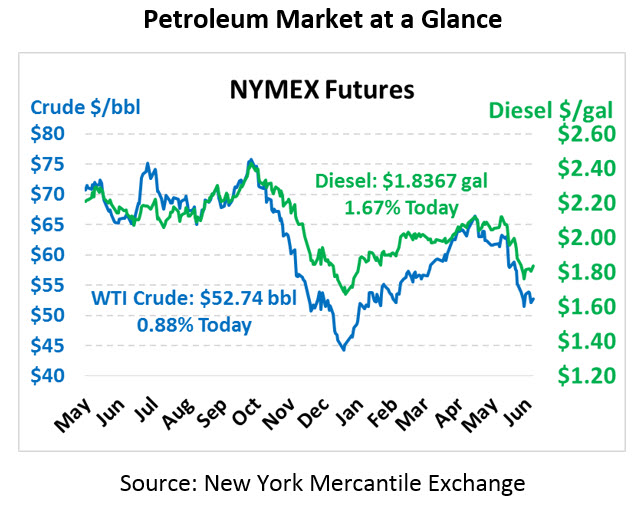

Today markets continue rising as the market grapples with the implications of the oil tanker attack in the Gulf of Oman. Crude picked up just over a dollar yesterday on geopolitical concerns. WTI Crude is trading at $52.74 currently, up an additional 46 cents.

Fuel prices received a similar lift yesterday. Diesel is trading at $1.8367, up 3 cents, while gasoline is trading at $1.7366, up 1.7 cents.

The US has released a video of an Iranian vessel approaching one of the damaged Japanese oil tankers and removing an undetonated mine, which they point to as proof that Iran was involved. Iran remains steadfast in their assertion that they were not behind the attacks, pointing out the convenient timing as Japanese officials were meeting with Iranian leaders.

The attack came near the Strait of Hormuz, a key global oil chokepoint. Iran has threatened on numerous occasions to shut down the Strait in response to US sanctions, furthering the argument against Iran. Given the uptick of violence in the region, traders are increasingly on the lookout for signs that Iran will take a more direct, aggressive stance in the area.

In fundamentals news, the IEA released their monthly report today, calling for slower oil demand growth in 2019 but a small uptick in 2020 demand. At the same time, the organization sees a strong uptick in Non-OPEC supply, meaning the group will have to cut output to 650 kbpd below May levels to keep markets balanced.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.