China Escalates Trade War with Rare Earth Exports

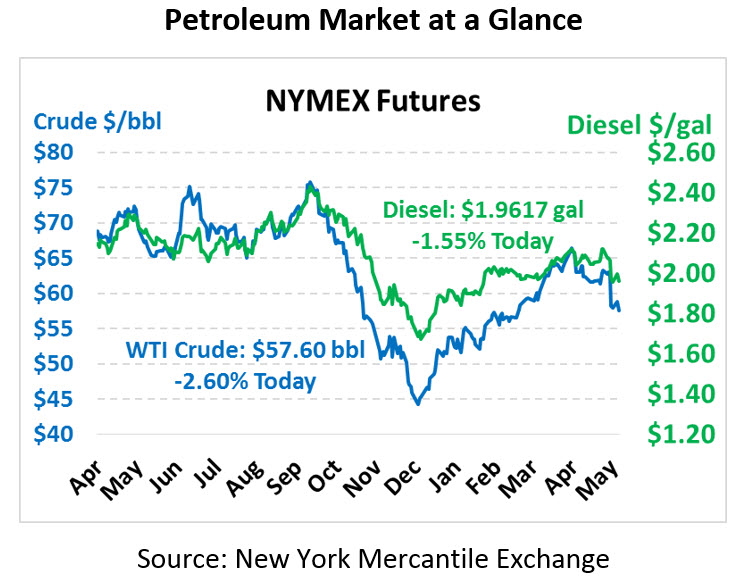

Markets are trading sharply lower once again amid a broader financial market sell-off. The Dow Jones Industrial Average over 200 points this morning. Crude is back at its lowest point since March. WTI Crude is trading at $57.60 this morning, down $1.54 from yesterday’s close.

Fuel prices are also significantly lower. Diesel prices are trading at $1.9617, 3.1 cents below Tuesday’s close. Gasoline prices are trading at $1.9142, down 4.3 cents.

The sell-off came after a Chinese newspaper suggested China could ban rare earth metal exports to the US as part of the on-going trade war. Rare earth metals are used in a multitude of electronic and manufacturing applications, and China controls nearly 70% of the world’s supply and makes up 80% of US rare earth metal imports. Despite the name, it’s worth noting that rare earth metals are not particularly rare, but finding economical deposits can be a challenge. If China includes rare earth metals in the trade war, it’d be a hefty escalation that would have a very severe effect on US producers.

Shipments of oil from Iran have continued to slide, dipping down to 400 kbpd in May according to ship tracking data from Reuters. Contrast this with their production in April 2018, directly before Trump imposed sanctions, when output was 2.5 MMbpd – more than 5x higher! Sanctions have had a strong effect on global markets, taking millions of barrels per day out of global supplies, leaving a large hole for OPEC to fill in.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.