Oil Inches Higher Following Last Week’s Sell-Off

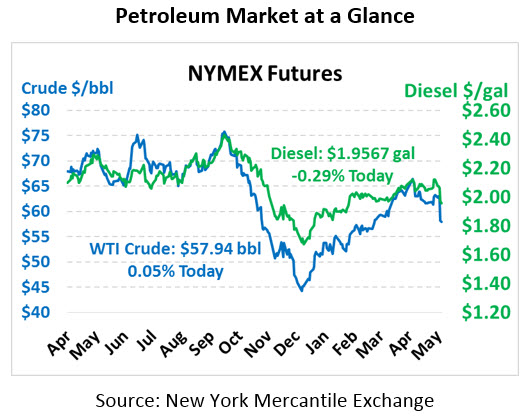

Oil markets are continuing to inch back after the long weekend, following Thursday’s hefty losses. This morning crude oil is trading at $58.87, roughly a dollar above its closing level on Thursday and 24 cents above Friday’s closing price.

Fuel prices are also on the up-mend as prices push back near $2/gal. Diesel is just shy of the level, trading at $1.9956 after picking up 2.4 cents since Friday. Gasoline prices are trading at $1.9559, a 2.1 cent gain.

The broad market sell-off comes as US-China trade talks have taken a turn for the worse. Some progress may occur in June at the G20 Summit between President Trump and Chinese President Xi, but any significant deal now seems quite far off. China has indicated that America’s requests are diametrically opposed to their state-run economic model, and that they will not give in to US demands. Trump last week put Chinese telecom giant Huawei on a trade blacklist, barring US companies from conducting business with the company that has dominated the race to 5G network speeds.

Shifting focus towards the Middle East, President Trump attempted to de-escalate US-Iran tension by stating that the US is not seeking regime change in Iran, counter to some of the rhetoric coming from the Iranian regime. Iran, for its part, said it has no intentions of re-entering the nuclear arrangement according to Reuter’s reports, choosing instead to weather the economic storm.

Kuwaiti oil minister al-Fadhel hinted that global oil markets may grow more balanced by the end of 2019, leaving room for OPEC to increase their agreed upon production quotas. The group will meet in June to discuss market conditions, setting the stage for a decision on whether cuts should be extended to the latter half of the year.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.