Oil Plummets on Bearish EIA Data

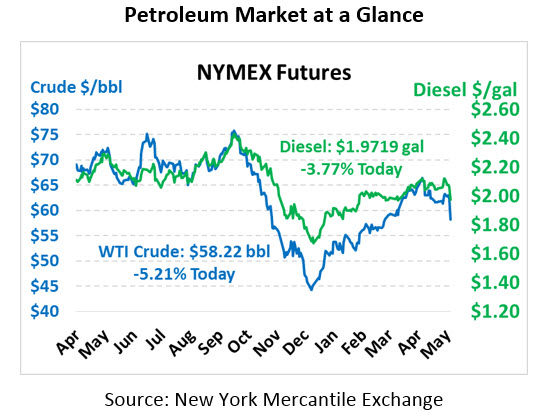

The bottom fell out from the market yesterday following a strongly bearish EIA report, and this morning prices are continuing their tumble. Crude oil is trading at $58.22, a hefty loss of $3.20 (-5.2%) for the day.

Fuel prices are also shaping up for some of the largest weekly losses this year. Diesel prices are trading at $1.9719, down 7.7 cents (-3.8%) since Wednesday and 12 cents below Monday’s opening price. Gasoline prices are $1.9144, down 7.7 (-3.9%) since yesterday and 13 cents since Monday.

As we noted yesterday, this year seems to be running behind the trend from a seasonal inventory perspective. While crude inventories typically fall into a de-stocking pattern by May, this year we’ve seen continued builds into late May. Even in 2016 with global inventories swelling, crude stocks hit their peak in early May before slowly declining. Still, inventories are bound to move lower eventually; the question now is how quickly they’ll revert lower and whether they’ll fall back below the historical average.

On the downstream end of the EIA’s report, refinery utilization dipped once again after popping above 90% last week. Rain along the Gulf Coast caused some refiners to temporarily fall offline, while in the Midwest the large BP Whiting facility (450 kbpd, or 3.2 MMbbls per week) saw some unplanned downtime. It’s no surprise, then, that the crude build were confined to the Gulf Coast and Midwest regions, while the rest of the country saw declining inventories. PADD 1C (Lower Atlantic) was the primary driver of the overall fuel products inventory builds, accounting for more than the entirety of the build for both products.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.