OECD Warns of Economic Risks from Trade War

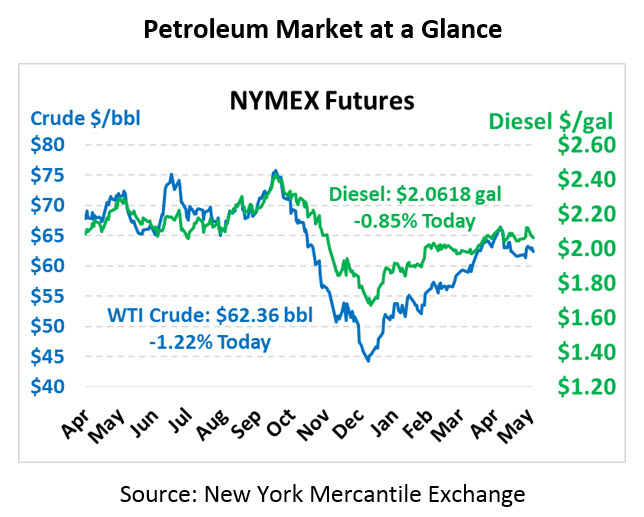

Oil dipped lower yesterday afternoon and this morning continues to fall. Crude oil is currently trading at $62.36, down 77 cents (-1.2%) from yesterday’s close.

Fuel prices are also moving lower, though moving slower than crude. Diesel prices are trading at $2.0618, down 1.8 cents (-0.8%). Gasoline prices are $2.0133, a 0.6 cent loss.

Yesterday the OECD reduced its 2019 economic growth forecast, citing the escalating roe between the US and China on trade. The group, one of the most influential groups in the Western world, said the trade conflict could reduce global GDP growth by up to 0.7% by 2021 if left unresolved, a $600 billion hit. The revised GDP number for 2019 now sits at 3.2%, down from 3.5% in 2018.

The API’s data yesterday was generally more bearish than markets had expected, with a headline build in crude stocks of 2.4 MMbbls for the week. Oil inventories typically rise until late April or early May, so the recent streak of gains has pushed a bit later than usual. Then again, Q1 saw inventories stay flat when the seasonal play is rising inventories, so it’s been a bit of an unusual year. What does that mean for the months to come? As refineries move into full gear and start producing closer to full capacity, expect crude stocks to begin falling, diesel stocks to start rising, and gasoline to trend flat for the summer.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.