Impact of fuel prices on logistics

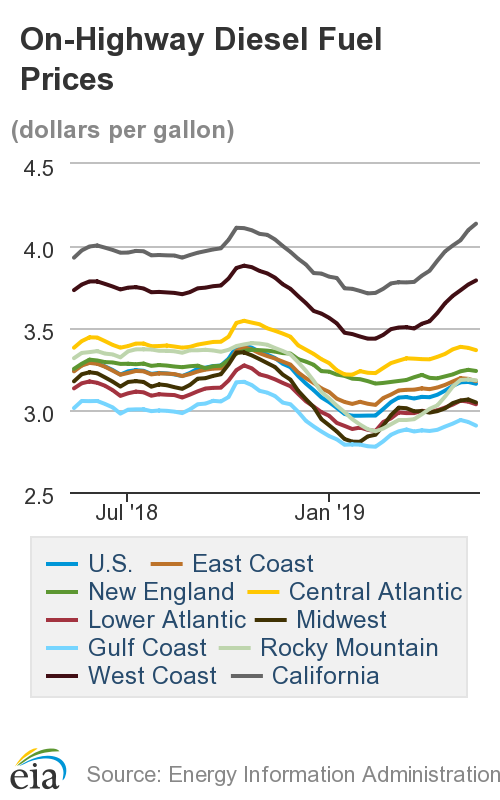

After declining at the end of 2018, fuel prices are beginning to creep back up in Q1. Much time is spent prognosticating on fuel price direction, yet the effects of price fluctuations are not always clear. Unsurprisingly, the consistent variability of fuel prices has a direct impact on the logistics industry.

Rising fuel prices present a challenge for freight management companies, as rising costs typically force carriers to either raise prices or suffer financial losses. When carriers raise rates, that increase is eventually passed along to the consumer as higher prices on goods and greater transportation costs.

Higher prices create a ripple effect throughout the economy. By pushing up prices of key consumer goods, higher energy costs end up in government inflation data, which informs Federal Reserve policy and, ultimately, interest rates. Ironically, higher inflation and interest rates have an inverse relationship with prices, meaning higher fuel prices ultimately influence factors that cause prices to return to lower levels.

Higher prices are also not felt uniformly throughout the world, which can disrupt the direction of trade flows and force logistics companies to pivot their strategies. For instance, when oil prices are high, some countries – especially developing economies – subsidize oil prices, keeping energy costs lower for domestic producers. This can artificially spur exports from those low-energy-cost countries that may otherwise not have been a market leader.

Finally, higher energy costs bring higher interest costs for those dealing in energy products. When fuel prices rise from $2.00 to $3.00 per gallon, interest costs rise 50% – even though no more fuel is trading hands. This can be a double whammy for logistics companies with extended credit terms, who not only face higher fuel costs but also extended credit terms. Since fuel is a top operating expense for most logistics companies, this can be a significant additional cost.

On the flipside, declining fuel costs make most goods cheaper – which can be both a blessing and a curse. Cheaper goods mean stronger economic demand, which in turn can strain logistics companies that must keep up. With a driver shortage already pressuring trucking companies, additional demand is hard to absorb. Logistics companies not ready to take on new volume may lose market share to competitors with more spare capacity.

Fuel prices are constantly changing, and the volatility keeps the logistics industry on its toes. To manage fuel price fluctuations, logistics companies can focus on improving their operations and finding efficiencies that enhance service levels. If they have a lower risk appetite, they may also choose to lock in their fuel price risk exposure to guarantee their budget numbers for the year.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.