IEA cuts oil demand but says supply will tighten on Middle East tensions

The International Energy Agency released their May Oil Market Report today cutting oil demand growth estimates for 2018 and 2019 but warned that supply will tighten given Iranian sanctions and resulting Middle East tensions. The agency cut estimates for last year’s global oil demand growth by 70,000 barrels per day to 1.2 million bpd while this year’s demand forecast was revised downward by 90,000 bpd to 1.3 million bpd. In particular, their forecast for Q1 2019 demand was slashed by 400,000 bpd which led to a 700,000 bpd increase in global stockpiles even as OPEC countries paired back production.

But the IEA cautioned that the current oil surplus may soon turn to tightness as demand recovers and supply is impacted by Iranian sanctions. According to the agency, total global oil supply fell by 300,000 bpd in April; of note, Iran’s crude production fell by 130,000 bpd last month to 2.61 million bpd ahead of the May expiration of waivers that allowed some consumers to continue buying Iranian oil. For comparison, back in 2017 Iran output averaged 3.8 million bpd. Once sanctions take effect this month, the IEA said that “Iranian production in May could tumble to levels not seen since the 1980s war with Iraq.” The agency said other producers may fill the gap though its unclear to what level and how quickly that will happen.

What to Watch Today

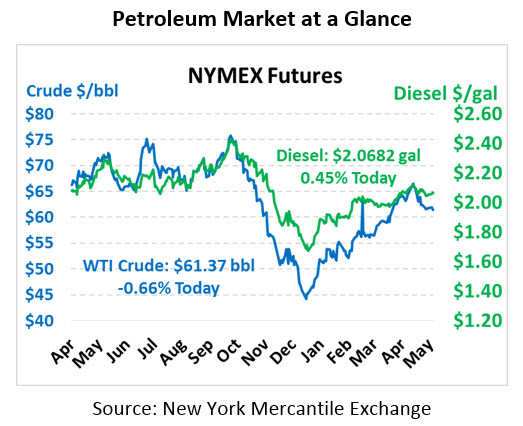

Oil prices started the early morning lower after the API forecasted a large U.S. crude inventory build of 8.6 million barrels despite consensus estimates that inventories fell by .8 million barrels. The API also forecasted a seasonally large 2.2 million barrel build in diesel stockpiles vs. analyst forecasts of a 1 million barrel expected draw and a .6 million barrel gasoline build vs. an estimated .3 million barrel draw. Traders will keep a close eye on the EIA Weekly Petroleum Report to see if it aligns with these API figures.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.