Iran Sanctions Complications Continue Oil Rally

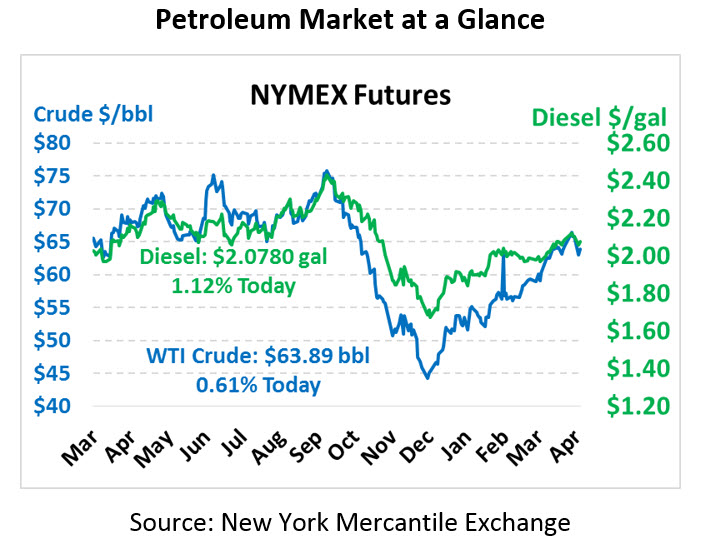

Oil prices are turning higher this morning thanks to supportive news from OPEC, following yesterday’s moderate gains. Crude oil is currently trading at $63.89, up a meager 39 cents (0.6%).

Fuel prices are trending higher as well, with gains outpacing crude thanks to uncertainty regarding European refineries reliant on a contaminated pipeline from Russia that has shut down. Diesel prices are currently trading at $2.0780, up 2.3 cents (1.1%). Gasoline prices are $2.1105, up 2.8 cents (1.3%) as markets fear a refined product outage during peak gasoline demand season.

Saudi Energy Minister Khalid al-Falih reported that OPEC+ members are beginning to reach a consensus on how production cuts will look in the second half of 2019, with “almost all” parties seeking a deal. Falih confirmed that Saudi Arabia will help fill in lost production caused by Iran sanctions, but they will not rush to exceed OPEC+ agreement levels. Saudi Arabia is currently producing well below its 10.3 MMbpd production limit set out in the OPEC+ deal, so they could increase production while still being compliant with the agreement.

In Venezuela, opposition leader Juan Guaido has declared he is “beginning the final phase of Operation Freedom,” surrounded by soldiers and military equipment. The Venezuelan military is seen as a key player in the on-going dispute between Guaido and Maduro; any opposition attempt will need to woo military support to take hold. Maduro’s regime indicated that very few military officials have switched sides, noting that all military garrisons support Maduro. As long as Maduro remains in control, American sanctions will continue to pressure Venezuelan oil output and contribute to tight global supplies.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.