OPEC to Fill Sanctions-Driven Oil Gap

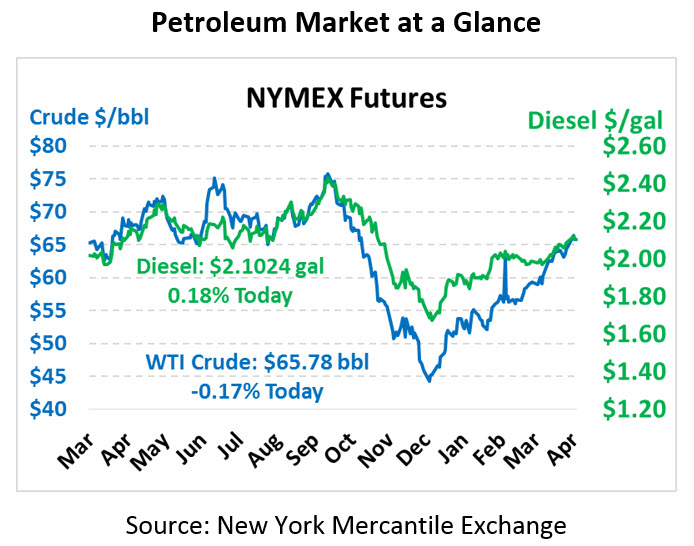

Oil is trading much lower this morning amid profit-taking and OPEC production claims. Yesterday Brent WTI crude hit $75/bbl for the first time since October, likely triggering some investors’ exit from the market to lock in profits. This morning, WTI crude is trading at $63.00, down $2.21.

Fuel prices are taking a heavy hit as well. Gasoline prices are trading at $2.0895 this morning, down 4.3 cents from yesterday’s new 2019 record high. Diesel prices are trading at $2.0388, down 5.9 cents.

OPEC is generally expected to fill the void once Iran’s exports are reduced, thanks to claims from the group that they will balance global markets. Russia, which has already been hinting that markets are balanced enough, is a prime suspect for increasing output beyond that of the OPEC+ agreement. Although the US claims they intend to send Iranian oil sales to zero, analysts groups such as Jefferies and FGE expect Iran will continue exporting around 400-600 kbpd of crude oil, down from current exports of 1 MMbpd.

The news hasn’t been all bearish today though. Q1 US GDP reports have been released, indicating 3.2% annualized growth in the first quarter of the year. If confirmed, this year would be the highest Q1 GDP growth since 2015, suggesting continued strong oil demand as we continue into summer months.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.