Iran Sanctions Complications Continue Oil Rally

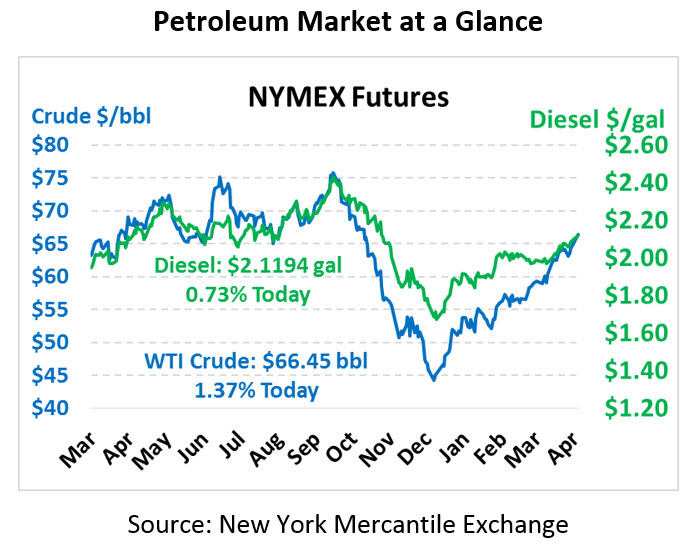

Markets continue rising this morning as markets focus closely on the unfolding Iran sanctions scenario. Crude oil is trading higher this morning and is currently trading at $66.45, up 90 cents (+1.4%).

Fuel prices are seeing less enthusiastic activity. Diesel prices are up roughly half as much as crude on a percentage basis, trading at $2.1194 after gaining 1.5 cents (0.7%). Gasoline prices are slightly negative, trading down 0.2 cents at $2.1278.

As the White House pushes Iran exports to zero, many are concerned with the supply consequences. Many had expected the White House to tighten Iran’s export, without necessarily taking it to zero. Analysts believe the $1.50/bbl rally yesterday was moderate considering the potential loss of 1.3 MMbpd in May. The muted price response seems to indicate strong confidence in OPEC to balance out supply markets, keeping prices from launching higher as summer demand picks up.

A significant complication for Iran sanctions will be China. China has been steadily increasing its purchase of Iranian crude under waivers. The country has expressed its disapproval at the waivers, claiming they violate China’s energy security and national sovereignty. With a historic trade deal between the US and China on the cusp of being signed, many wonder if the US will still impose sanctions on China and risk the trade deal. Either option is bearish for markets – a failed trade deal will decrease demand, while China’s continual oil purchases from Iran would reduce supply tightness.

Adding to market volatility is uncertainty over Libya. After years of supporting a UN-based peace process, the US appears to be switching sides to support the insurgent military, led by General Khalifa Hifter. While many have decried the corruption of the internationally recognized Libyan government, most Western countries supported UN activities towards peace and reforms, rather than a violent revolution. Last week, Trump called Hifter and commended him for his counterterrorism efforts and for his protection of Libyan oil. The US hopes that Hifter can quickly consolidate power and avoid excessive instability, though the short-term consequence may be additional violence and uncertainty.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.