US Tells Iran Oil Importers to Stop Purchases

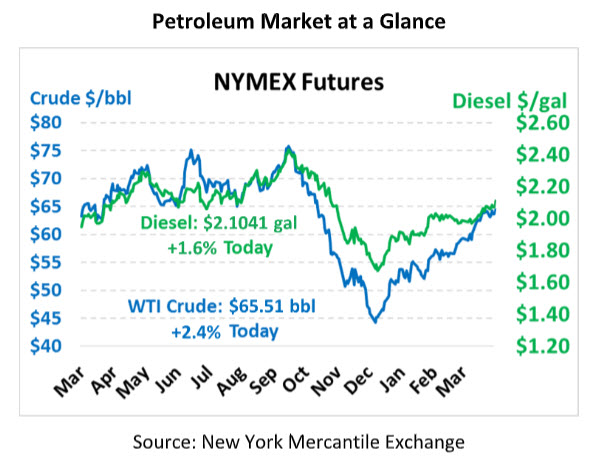

After waiting some time for clarity on Iran sanctions waivers, the White House has provided some clarity, which is causing oil prices to move rapidly higher this morning. Crude oil is currently trading at an annual high of $65.51, up $1.51 (+2.4%) from Friday’s close.

Fuel prices are also moving quickly, with large gains for both gasoline and diesel prices. Diesel prices are currently trading at $2.1041, up 3.3 cents (+1.6%). Gasoline prices are trading at $2.1354, up 6.3 cents (+3.1%). Notably, gasoline closed higher than diesel on Friday for the first time since July 2018.

US officials gave word that all waivers on purchases of Iranian crude will be discontinued, which will cut Iran’s meager 1 MMbpd stream of exports to virtually zero. Trump tweeted that Saudi Arabia and other OPEC countries will offset the difference, and Saudi Arabia has indicated they will work with OPEC countries to ensure balanced markets (though their statement fell short of guaranteeing more supply). Sanctions are set to expire on May 2.

Iran has responded that they will shut down the Strait of Hormuz if not allowed to continue using the critical maritime chokepoint, though it’s unclear whether that is a response to sanctions or a preventative response to any military action in the Strait. Earlier this month, Trump labeled Iran’s Revolutionary Guard a terrorist threat, the first time the US has used the label on a sovereign country’s military.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.