Colorado Tightens Regulations on Oil & Gas

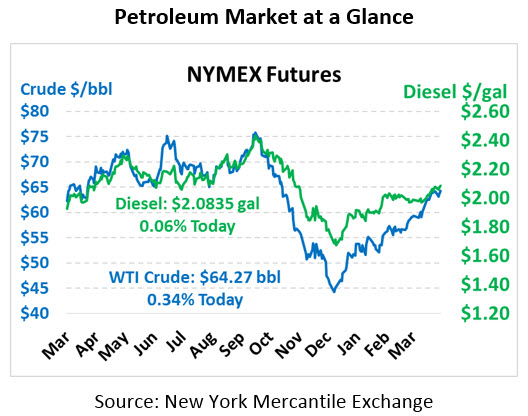

Oil is popping higher on strong economic news in China where GDP growth in Q1 was estimated 6.4%, slightly above Reuters estimates of 6.3%. Yesterday saw prices rise to close back over $64/bbl, in line with the recent $63-$64 trading range. Today, crude oil is trading at $64.27, continuing its gains by rising 22 cents.

Fuel prices are also getting a lift this morning, though diesel is seeing pressure from the API’s data. Diesel prices are trading at $2.0835, up 0.1 cents. Gasoline prices are at $2.0444, up 1.3 cents.

The API’s report highlighted a moderate draw in crude oil stocks, compared to expectations for a small build. Diesel surprised in the opposite direction, rising instead of falling. The EIA’s report this morning will shed more light on true inventory levels in the US.

Colorado this week signed Senate Bill 19-181, which tightens regulatory oversight of Colorado’s oil and gas industry. The legislation requires that “public health, safety, and welfare, and the environment” be taken into consideration on all oil and gas projects, while increasing local jurisdictional approval of new drilling oil and gas activity. Proponents say the new bill will give local cities and counties more control over their local interests, while opponents claim it threatens an industry that supports 230,000 jobs in Colorado and accounts for over half of all tax revenue. While Colorado accounts for a fairly low amount of national US output (just over 4%), it has enormous growth potential, having grown production 5X since 2011.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.