Week in Review

For the week, the crude market was up. The week started off bullish with a strong jobs report and news of Libyan instability pushing the market upward. Continued fears of a global economic slowdown kept the bulls in check as the week progressed, but news of a large draw at Cushing added support for the bulls’ mid-week push. This was followed by some profit taking amid recent concerns of a looming EU trade dispute, but we close the week seeing the bulls firmly in charge in early trading on Friday.

A mixed bag of news led to an up and down market this week. All eyes had been on Libyan instability as the week began which encouraged a bullish stance. Tariffs and trade with the EU have begun to impact thinking as well as Brexit. These topics have mixed effects on the market depending on recent developments, but are generally bearish. The market is hoping for a resolution to the U.S.-China trade talks soon and the sentiment is generally bullish amid positive tweets from Trump. For all these factors, only time will tell how they will play out in the markets.

Finally, hurricane season is around the corner – starting June 1. Earlier this month, the first predictions for the season were published, indicating a milder hurricane season with six hurricanes, two of which will be named storms. Forecasts currently show a strong El Nino forces keeping hurricane formation limited, though early forecasts are less accurate this far in advance. Let’s keep our fingers crossed this year is calmer than the last two.

Prices in Review

Crude opened the week at $63.33. We saw a 2019 high mid-week at $64.61 and some profit taking after that, but in early trading today, we see the bulls back on track. Crude opened Friday at $63.71, a gain of 38 cents (0.6%)

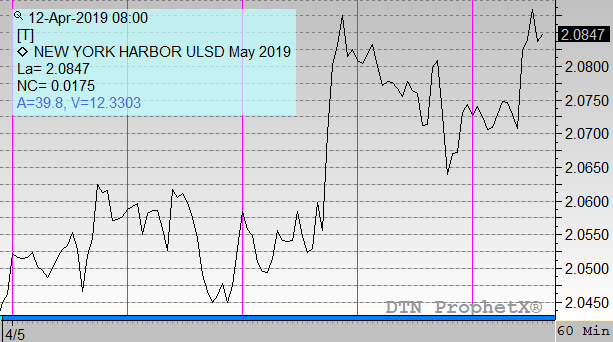

Diesel opened the week at $2.0449. It had a nice gain on Wednesday following crude. It opened Friday at $2.0751, a gain of 3 cents (1.5%)

Gasoline opened the week at $1.9800. It followed crude to end the week. It opened Friday at $2.0361 a gain of 5.6 cents (2.8%)

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.