Gearing Up for a Tariff-ic Summer

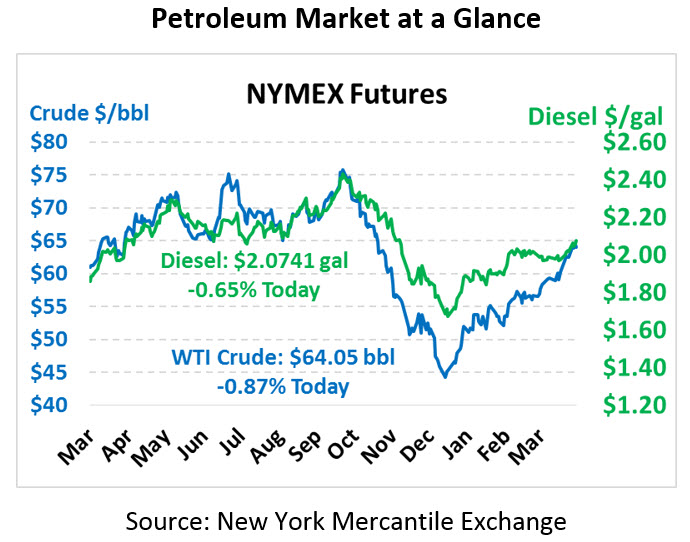

After pushing new annual highs yesterday, oil prices are cooling off some as traders pocket their profits and exit the market. Crude oil is currently trading at $64.05, down 56 cents from yesterday’s close.

Fuel prices are also moving lower. Diesel prices are trading at $2.0741, down 1.4 cents. Gasoline is experiencing even faster losses, trading at $2.0462 after shedding 2.3 cents. The large gasoline losses are surprising given the large stock draw, but partially explained by an inventory build locally in PADD 1A, home to the NYMEX RBOB delivery point at NY Harbor.

Yesterday’s EIA data showed some huge activity in both crude and gasoline inventories, though in the opposite direction. Gasoline demand popped well above last week’s level, reaching 9.8 MMbpd last week (over half a million barrels above this week last year). The steep drawdown in gasoline comes as refineries are nearly 1 MMbpd behind in crude intakes relative to last year, meaning higher demand but less supply. Low refinery activity (due to both planned and unplanned shutdowns) caused crude oil to stay in the ground, while gasoline kept flowing through the pump. Tight gasoline supplies now are expected to loosen in the coming month, creating ample supplies to meet high summer demand.

Trump’s Next Trade Battle: EU

With the US still working on mending trade relations with China, Trump is already preparing for his next skirmish – this time with Europe. Since 2004, the US and EU have been going head-to-head over aviation subsidies, with both sides claiming the other has illegally subsidized Boeing (US) or Airbus (EU). Last year, the WTO ruled that the EU had illegally subsidized Airbus, opening the door for the US to impose tariffs to recoup losses.

Fast forward now to Tuesday, when Trump tweeted out of the blue that the US is now planning tariffs on $11 billion of EU goods. Although the WTO has yet to approve that exact figure, it’s likely that the US will impose some tariffs on our key European trade partners. Of course, earlier this year the WTO ruled that Boeing had also received illegal subsidies, meaning the EU will be imposing their own sanctions on the US.

The retaliatory response is reminiscent of last year, when Trump slapped tariffs on EU steel and aluminum. Both parties reached a truce after that, but many fear that Trump will continue stirring up economic strife between countries. Still, this latest battle has a silver lining – both sides are going through the WTO, the international body regulating trade, for their responses. The process has been orderly and well within legal precedent, meaning it shouldn’t (hopefully) escalate beyond the tariffs already discussed.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.