Week in Review

For the week, the crude market was up. Strong bullish sentiment from the beginning of the week to mid-week was supported by OPEC+ news of the continued goal of tightening supply led by Saudi Arabia. In addition, positive news from U.S.-China trade talks helped to drive markets above the $60 dollar threshold. We end the week seeing some profit taking and crude prices coming down off their 2019 highs.

A driving factor for the bulls this week was news of good progress coming from U.S.-China trade talks. Having a deal in place would help boost the global economic outlook and oil prices. Also bullish for crude, Mike Pence seemed to indicate this week that crude prices were competitive right now so could withstand keeping pressure on Iran and Venezuela. A large surprise crude build reported by the EIA mid-week hardly put a dent in the bullish trajectory this week, but we have seen some profit taking to close the week.

Four Canadian provinces were required to impose federal carbon taxes of $20/ton of CO2 on April 1, which for fuel prices equates to a 4.4 cpl increase for gasoline eand a 6.4 cpl increase for diesel. By 2022, that tax will rise to 11 cents and 16 cents, respectively. Supporters tout the environmental benefits of the tax and also claim tax rebates will more than cover the additional costs for average households. Opponents claim the measure will increase the costs of all products, not just fuel, dampening consumer spending.

Prices in Review

Crude opened this week at $60.24. We saw strong gains through mid-week with some profit taking to close the week and bring prices down from 2019 highs. Today, the market opened up for the week with WTI opening Friday at $62.18, a gain of $1.94 (3.2%) for the week.

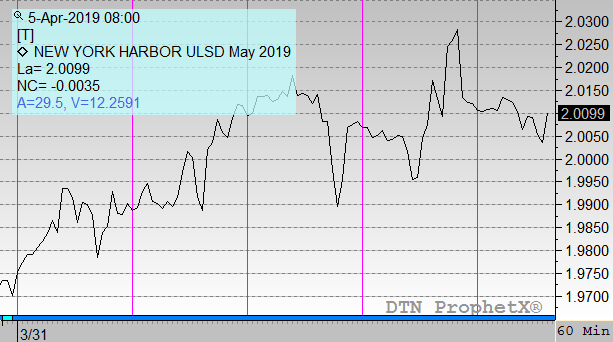

Diesel opened the week at $1.9700. Diesel followed crudes bullish trajectory this week. It opened Friday at $2.0130, a gain of 4.3 cents (2.2%) for the week.

Gasoline opened the week at $1.8827. Gasoline followed diesel and it opened Friday at $1.9338, a gain of 5.1 cents (2.7%) for the week.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.