Oil Falls from 2019 High, Economic Concerns

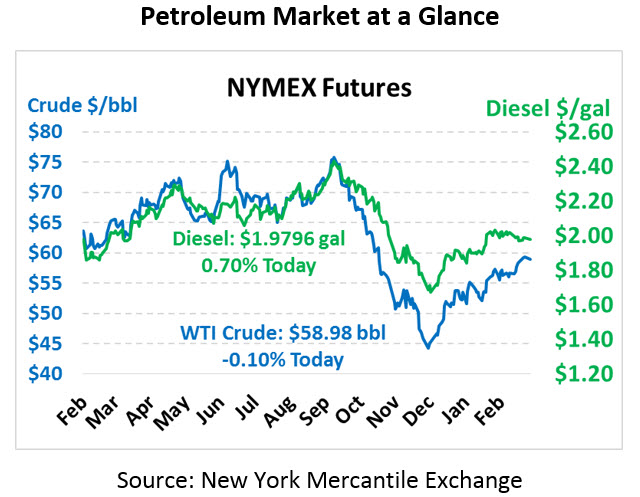

Friday saw the oil complex turn a bit lower on weak economic data in the Eurozone and profit-taking. This afternoon crude oil is trading relatively flat, though fuel prices are on an upward march. Crude is currently trading at $58.98, down 6 cents

Fuel is trending upwards with diesel trading at $1.9796, up 1.4 cents. Gasoline is up fractionally trading at $1.9328, up 0.7 cents.

Friday’s near dollar-per-barrel decline was spurred by weak activity in Europe, which led to strong gains for the dollar and commensurate losses in oil products. Markets are also growing more cautious as the Federal Reserve urges “patience” for further rate hikes. Higher interest rates are like pumping the breaks on the economy – they limit growth, but they also signal that the economy is growing fast. The Fed’s decision to slow their rate hikes is helpful for markets, but also shows their concerns about economic growth for the rest of the year.

Investors are beginning to return to oil in droves, as we made clear in the most recent CFTC report. Net long investments among money managers climbed to the highest level since 2018, signaling more buying interest for the product. Rising net long positions have spurred prices higher, though this most recent increase did not produce a comparable increase in prices.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.