Week in Review

This week the market was relatively flat, but most of the major news this week seemed to be bullish in nature which supported a mild upward trend through the week with a sell off on Friday giving back the gains.

Bullish news included the OPEC committee responsible for recommending changes suggesting leaving the supply cut deal unchanged until June. Other bullish news included Secretary of State Mike Pompeo being quoted during CERAWeek saying the US intends to take Iranian output to zero “as quickly as market conditions will permit.” Also supporting prices this week was the large unexpected draw on crude stock as reported by the EIA. Finally, the Federal Reserve announced that they have no plans to hike interest rates for the remainder of 2019 which is bearish for the dollar and in turn bullish for oil prices.

Prices in Review

Crude began the week opening at $58.45. The market was relatively flat until Wednesday and Thursday when we saw modest gains. Today the market opened up for the week, but we see indications that the market may be giving back those gains in early trading. WTI opened on Friday at $59.87, a gain of $1.42 (2.4%) for the week

Following crude, Diesel seems to be giving back some of its gains for the week in end of the week trading. Diesel opened the week at $1.9663. It jumped in price mid-week on the news of a larger than expected draw in inventories, but came back down to open Friday at $1.9847, a gain of 1.8 cents (0.9%).

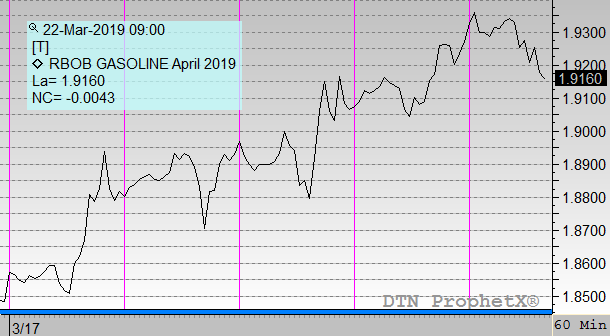

Gasoline opened the week at $1.8535. It pushed steadily upward through the week to open Friday at $1.9275, a gain of 7.4 cents (4.0%)

Read about the impacts of the this week’s Midwest floods on fueling economics.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.