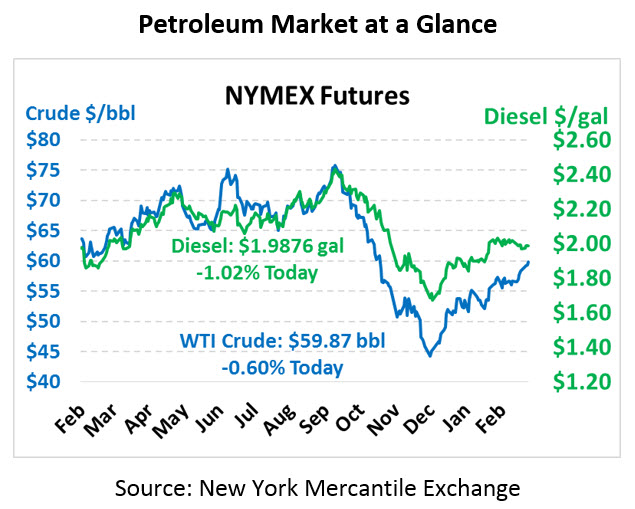

Oil Hits 2019 High of $60/bbl

Yesterday’s headline crude draw sent crude oil prices rocketing above $60/bbl for the first time since November 2018, while simultaneously carrying fuel prices higher. Today crude oil prices are turning lower, trading at $59.87, down 36 cents compared to Wednesday’s close.

Fuel is trading mixed heading into afternoon trading. Diesel prices are leading the losses this morning, trading at $1.9876 after falling 2.1 cents. Gasoline is remaining stubbornly higher, at $1.9273, a gain of 1.1 cents.

The massive crude oil draw reported by the EIA came on the heels of strong export data, while imports saw only mild gains week-over-week. As one of the most transparent oil data points in the world, US crude stocks have a wide-ranging impact on the market, signaling tightness in global stocks. Venezuela sanctions have played a major role in the decline in imports, with Venezuela imports reaching 0 for the first time one record. Morgan Stanley set their Brent crude price target for Q3 at $75, signaling bullish forces in the market.

In economic news, the Federal Reserve on Wednesday revealed they have no plans to hike interest rates for the remainder of 2019, saying now is a good time for patience. The Fed will also slow its policy of Quantitative Tightening, unwinding the trillions of dollars in bonds purchased following the 2008 recession. The choice to stop hiking interest rates is bearish for the dollar, which is in turn bullish for oil prices.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.