Oil Draws Provide Mild Price Support

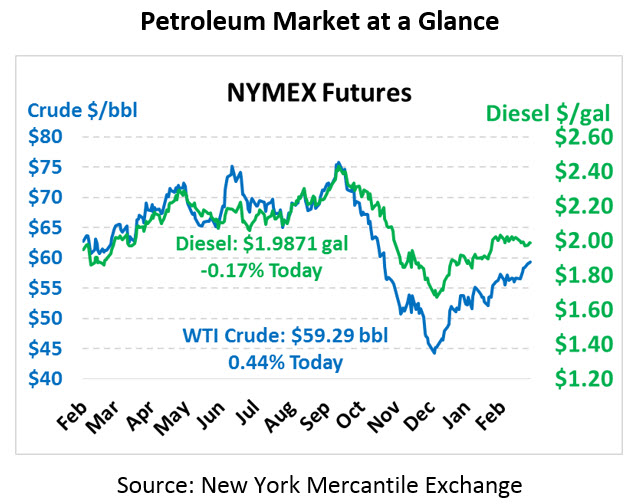

Oil is trading mostly flat this morning after trading higher overnight. The market is looking forward to the Fed’s monetary policy statement, which will be released later today. Few market participants expect a rate hike this go-round after recent calls for patience, but if a hike does occur it would send oil prices (and equity prices) lower. Crude oil is currently trading at $59.29, up 26 cents from yesterday’s close.

Fuel prices are mixed this morning. Diesel is trading at $1.9871, down 30 points. Gasoline, on the other hand, is trading at $1.9003, up 0.7 cents.

The API’s inventory report roughly matched market expectations except for a headline draw in crude inventories, accompanied by a draw at Cushing OK, the delivery point for WTI crude. Markets worry that continued draws demonstrate the effects of Venezuela and Iran oil sanctions, which are expected to send global markets into undersupply in the coming months. In fact, Venezuela has now suspended oil exports to India – previously its second largest cash-paying customer after America, further disrupting markets. Huge across-the-board inventory draws reported by the EIA should give prices a strong lift heading into afternoon trading, with crude falling almost 10 million barrels relative to next week.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.