Oil Hits Multi-Month High

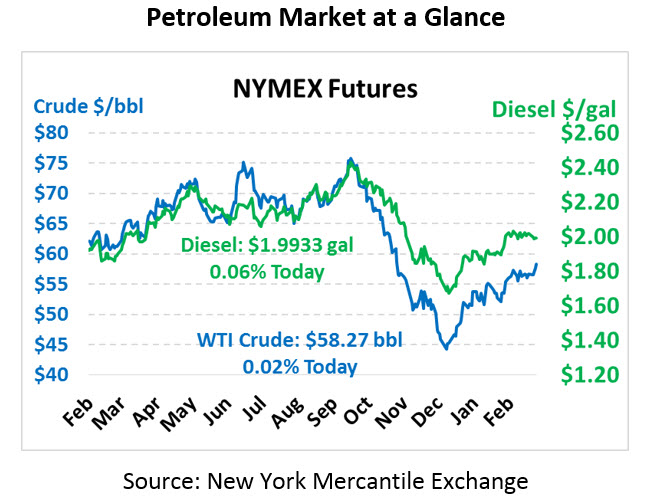

Crude oil saw a decisive break above its recent trading range of $55-$57, closing well over $58/bbl yesterday on strong EIA data. Today crude is up a penny trading at $58.27.

Fuel is following crude and is trending upward this morning. While diesel is up fractionally, gasoline is up 1.3 cents.

The EIA’s data not only confirmed the API’s data, but showed an even steeper draw in crude oil at a time when many US refineries are still going through planned maintenance. Refinery utilization rose by just .1%, but crude stocks still fell 3.9 million barrels. The decline also marks the first time crude has fallen below the five-year average level since last fall. Across all petroleum liquids, inventories fell by over 10 million barrels week-over-week.

In international news, the world is watching the EU. UK’s Parliament just voted to not leave the EU without a deal in place to manage the transition (a scenario known as “Hard Brexit”). The trade has been anxious about the looming deadline at the end of this month – a Hard Brexit would cause severe economic disruptions to ripple through international markets. This recent vote appears to delay the UK’s exit from the EU until a deal is reached, though the EU must agree to those terms. Parliament now must decide whether or not to pass the existing Britain-EU agreement, which has already been rejected by the group twice. If no deal is reached in the near future, expect significant uncertainty to alternately pump up and deflate financial markets, taking oil along on the bumpy ride.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.