Supply and Finances Fight for Oil Price Direction

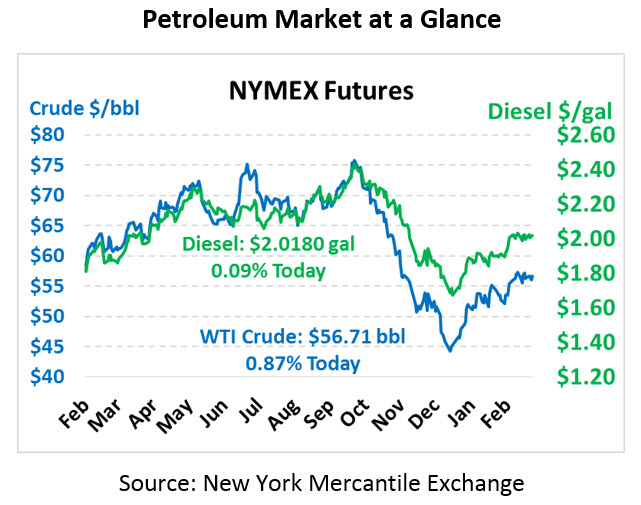

Oil prices are taking a heavy hit this morning, breaking below the $55/bbl threshold on news that the European Central Bank is keeping interest rates unchanged – a move which strengthens the dollar and signals a weak economic outlook. Crude oil is currently trading at $54.97, down $1.69 (-3.0%) since yesterday.

Fuel prices are experiencing significant losses this morning in conjunction with crude oil. Diesel prices are currently trading at $1.9611, down 5.2 cents (-2.6%). Gasoline prices are $1.7520, losing 5.3 cents (-3.0%) since Thursday’s close.

Oil prices are locked in battle with weak equity markets. The DJIA has fallen 4 days so far this week amid US-China trade concerns and poor growth expected in 2019. The European Central Bank not only announced their decision not to hike interest rates in 2019; they also projected a puny 1.1% EU GDP growth for the year (down from 1.9%). The US Dollar rose to levels not seen since last November, pushing down oil costs.

US-China trade remains a contentious issue. Although officials keep reporting progress and effective negotiations, the two parties have yet to sign any agreement. Terry Branstad, the US ambassador to China, said no summit has been scheduled and a deal is not imminent, according to the Wall Street Journal. Bolstering that news is a report that Chinse exports in February were more than 20% below those levels a year ago.

The physical oil market seems somewhat less bearish than the financial arena. While Libya has resumed production at its El Sharara field, Venezuela is suffering. The State Department noted yesterday that additional sanctions could be imposed on countries doing business with Venezuela, making sanctions more similar to Iran-style penalties. Such a move would cause a quick reaction from the buyers who have taken up Venezuelan crude, though countries such as China, Russia and India might balk at the additional restrictions. Venezuela’s oil company PDVSA is on the brink of declaring force majeure on some import and export contracts, putting the market more at risk.

Which factor – financial or physical – will play a larger role in 2019 is yet to be seen. While physical dynamics are important, oil prices are largely driven by investors and speculators, who take their cues from the financial world. There’s a good deal of economic risks in the market – it’s been a decade since the last US recession, and markets seem to be slowing. During the 2008-09 recession, oil prices fell 75% from $145 to just $35. But after that sell-off, prices soared back to $110. Smart buyers took advantage of those low prices in 2008-09 to lock in lower fuel costs. With economic prospects poor today, savvy buyers should initiate conversations with the suppliers to lock in potentially lower prices if a recession does occur.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.