EIA Shows Large Crude Build, Return of Imports

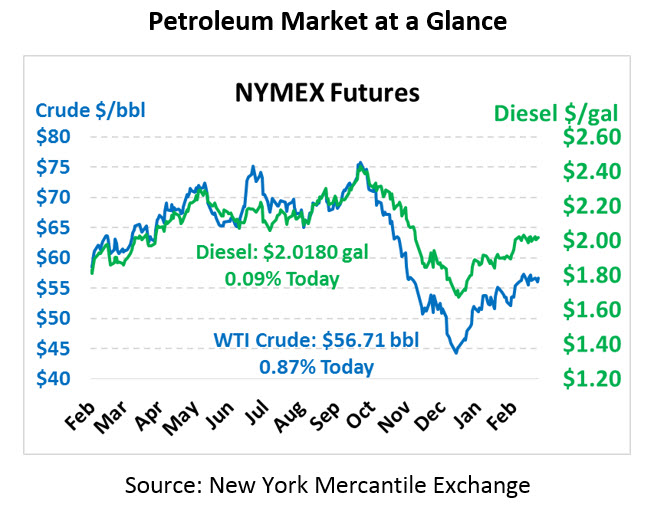

Crude experienced some modest selling pressure yesterday. Today, however, crude is up trading at $56.71, up 49 cents. Diesel is flat compared to yesterday, trading at $2.0180. Gasoline is trading at $1.8032, up 1.4 cents.

Markets are looking to Venezuela this morning, where data shows that only 3.2 million barrels of Venezuelan crude oil have been exported in the first six days of the month. At half a million barrels per day, exports appear to be down almost 50% compared to pre-sanction levels. With the country struggling financially, companies have begun to abandon relations with Venezuela’s oil company PDVSA.

The EIA’s data roughly confirmed the API’s report, with both posting sizable crude builds for the week. Imports rebounded by a million barrels per day, accounting for nearly all of the increase in crude stocks. Refinery utilization remains weak, with refiners using just 87.5% of their total capacity, leaving plenty of crude in storage. In line with reduced refinery activity, gasoline saw large draws, particularly as suppliers begin draining their winter gasoline to prepare for the April 1 conversion to summer gasoline.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.