Quiet Post-Holiday Market

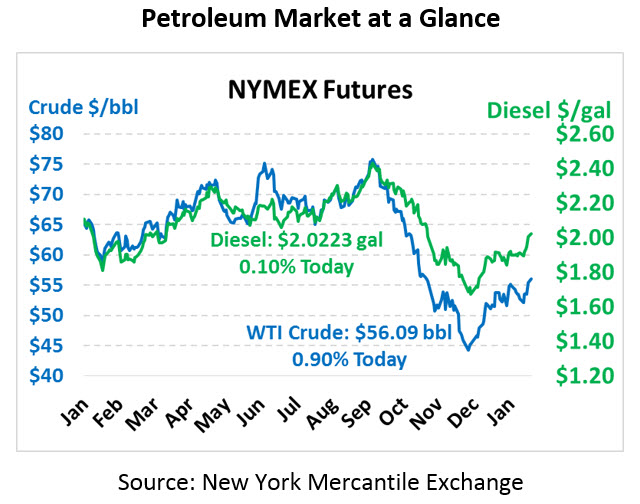

After closing early yesterday in observance of President’s Day, oil markets are continuing to trade in line with Friday’s closing price. Brent settled above its 100-day moving average for the first time since October 2018, which could lead to stronger buying interest from fund managers. WTI crude remains below its 100-day moving average of $57.45. Crude is trading at $55.94 this morning, up 35 cents from Friday’s close.

Fuel prices are slightly below their Friday levels, though still near multi-month highs. Diesel prices are trading at $2.0003, down 2 cents from Friday’s close but still above the $2/gal mark. Gasoline prices are down just over a penny, trading at $1.5624.

Markets are fairly quiet this week, with the news relatively light. Although markets continue reacting to developments related to Iran, Venezuela, and Saudi production (not to mention US-China trade), new developments have been small. Recent reports suggest that India has been absorbing much of Venezuela’s excess supplies, increasing its imports as much as 65% compared to January. Yet Venezuela’s production is still struggling given lack of diluent shipments from the US to facilitate the flow of their heavy crude oil.

Tanker tracking data suggest that Iran’s crude oil exports have remained higher than expected, roughly 1.25 MMbpd this month, in line with January’s levels. That’s well below 2017’s average export rate of 2.2 MMbpd, but certainly not the zero that some in the State Department had wanted. Trump’s waivers have allowed a significant amount of Iran’s crude to continue leaving the country, though waivers expire in May. If Iran’s exports remain high after full sanctions are imposed, it could cause a global oversupply of crude that would send prices lower.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.