Markets Hit 3-Month High on Supply Concerns and Trade Optimism

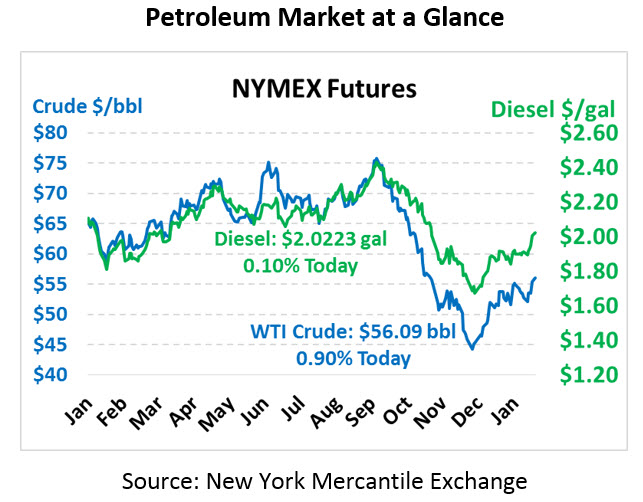

While most financial markets are closed today, NYMEX energy prices continue trading this morning. Despite an increase of 3 rigs in the Baker Hughes rig data, oil prices are setting their aims higher this morning. After closing at the highest level in three months on Friday, WTI crude oil is trading at $56.09 this morning, up 50 cents from Friday’s close.

Fuel prices are trading relatively flat today, with both gasoline and diesel prices seeing multi-month highs on Friday. This morning, diesel prices are trading at $2.0223, up 0.2 since Friday’s close. Gasoline prices are $1.5740, hardly changed with just a 0.1 cent move.

Oil is trading higher thanks to improved sentiments on US-China trade talks and Saudi Arabia committing to even steeper cuts next month. On the former point, markets seem to believe that US-China trade is too big an issue to jeopardize, so both countries will do what it takes to make a deal work. Trump indicated last week he might be willing to postpone the March 1 deadline if talks are making headway. Any delays are a boon to the market, which fears what could happen if tariffs on $200 billion of goods are raised to 25%, putting a $30 billion drag on trade.

On the latter issue, Saudi Arabia seems to be making up for Russia’s slow progress towards achieving their production quotas. Saudi Arabia has committed to cutting March supply by half a million barrels per day beyond its pledged level, which will rapidly spur global inventory draws. On the flip side, Russia, which promised 230 kbpd cuts in 2019, has been phasing in its cuts, achieving just 42 kbpd reductions in January. February is expected to bring just 120 kbpd in cuts, roughly half of the pledged amount. Russia claims that geology and cold weather require them to move slowly when cutting production.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.