Midwest Cold Shuts in Refineries

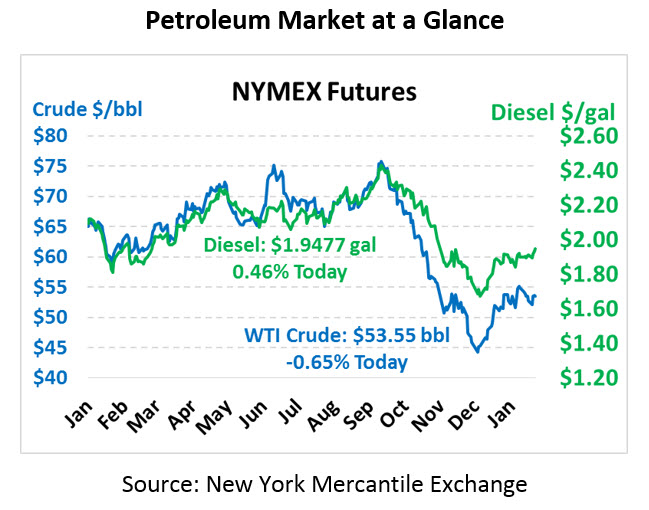

Although the EIA’s weekly oil report appears bearish on first glance, markets moved higher regardless. Crude oil rallied on a significant Cushing crude draw. After rising 80 cents yesterday, crude oil is trading at $53.55 this morning, down 35 cents.

In contrast, fuel prices are trading in the black this morning thanks to high refinery utilization rates, and both gasoline and diesel prices posted their strongest closes of 2019. Diesel prices this morning are trading at $1.9477, up 0.9 cents from yesterday’s close. Gasoline prices are trading at $1.4757, up 1.1 cents.

The EIA’s data showed across-the-board builds for oil products, though at the same time they reported a draw of crude oil at Cushing, the physical delivery point for WTI crude contracts. Crude’s build was larger than expected due to declining refinery utilization rates, while fuel stocks were buoyed by reduced exports from the Gulf Coast due to fog.

US December retail sales fell by the largest amount since 2009, which is weighing heavily on equity markets (and therefore, oil prices) this morning. Leading the decline was lower gasoline station sales – not surprising given the rapid decline in fuel prices. But other categories, such as internet sales and restaurant sales, were down as well. Although the month certainly came with its share of headwinds – weather, the start of a government shutdown, etc – the results are certainly not a positive sign for the global economy. If retail demand weakness continues, it could eventually lead to slower job growth and less fuel demand.

On the other hand, Trump noted that US-China trade talks are “going very well” as negotiators meet in Beijing. China’s President Xi Jinping will join delegates on Friday, though Trump is expected to remain on the sidelines for now. Negotiators have until March 1 to agree to a resolution or at least a deadline extension, before tariffs are raised on $200 billion of goods.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.